TTML (Tata Teleservices) शेयर कैसा है? खरीदें या बेचें 2025 ||

Tata Teleservices (Maharashtra) Limited (TTML) टाटा समूह की एक telecom कंपनी है जो अपने consumer mobile business से enterprise services में complete transformation के दौर से गुजरी है। अगस्त 7, 2025 को कंपनी का शेयर प्राइस Rs 57.13 पर trade कर रहा है, जो Rs 11,169 करोड़ के market capitalization के साथ है। हालांकि, कंपनी की वित्तीय स्थिति गंभीर चुनौतियों से भरी हुई है – negative book value Rs -91.02 per share के साथ, Rs 20,342 करोड़ का भारी debt burden, और persistent losses के कारण यह एक high-risk investment proposition बन गई है।

TTML Company का इतिहास और Business Model Transformation

Consumer Mobile से Enterprise Services तक का सफर

Historical Journey:

- 1996: Fixed-line services के साथ शुरुआत

- 2002: CDMA operations launch किए

- 2008: GSM services शुरू की और NTT Docomo से Rs 14,000 करोड़ investment

- 2014: NTT Docomo exit के बाद financial stress

- 2017: Consumer mobile business shutdown का निर्णय

Consumer Mobile Business Exit:

- October 2017: Bharti Airtel के साथ merger announcement

- January 2019: NCLT approval for composite scheme

- July 1, 2019: Consumer mobile business effectively transferred to Airtel

- Debt Liability: Rs 40,000+ करोड़ debt remained with Tata Group

- Asset Transfer: 180 MHz spectrum और ~40 million subscribers को Airtel को transfer

Current Enterprise-Focused Business Model

Tata Tele Business Services (TTBS) Portfolio:

- Primary Focus: SMEs और Enterprise customers को comprehensive ICT solutions

- Service Areas: Maharashtra और Goa circles में operations

- License: Unified License with Access Service Authorization

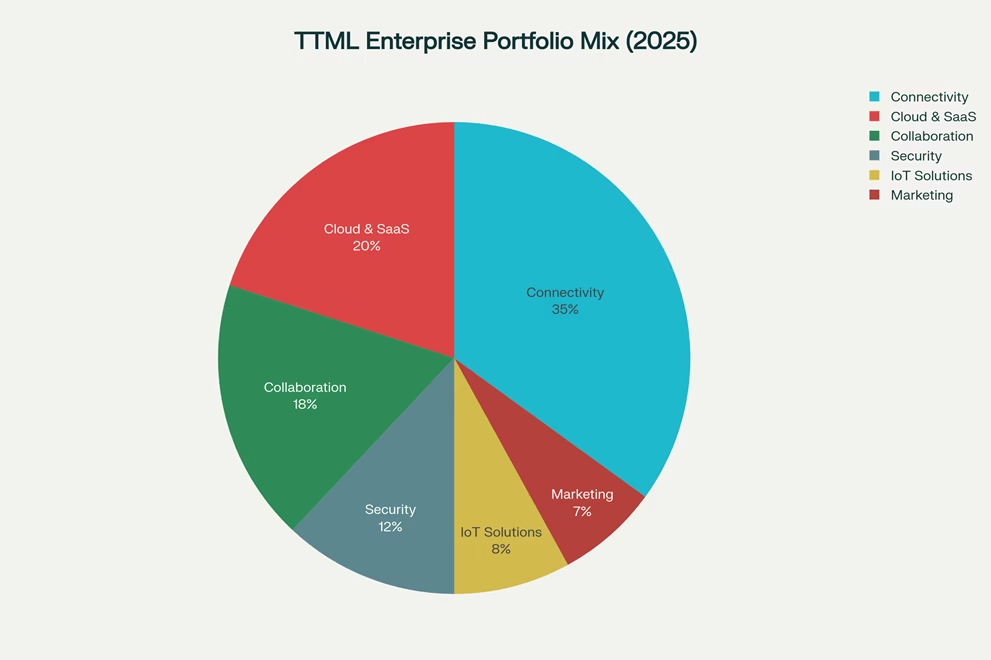

TTML’s enterprise service portfolio is diversified across connectivity, cloud, collaboration and security solutions

Service Portfolio Breakdown:

- Connectivity Solutions: Leased lines, internet, MPLS, SD-WAN services

- Collaboration Tools: Video conferencing, audio services, Smartflo platform

- Cloud & SaaS: IaaS, managed cloud services, cloud-based applications

- Security Services: Cybersecurity solutions, firewall, endpoint protection

- IoT Solutions: Connected devices, M2M communication

- Marketing Services: Digital marketing solutions, customer engagement platforms

Interior view of Tata Teleservices Ltd. corporate office with workstations and motivational banners

TTML: Current Financial Position और Performance Analysis

Q1 FY26 Financial Results

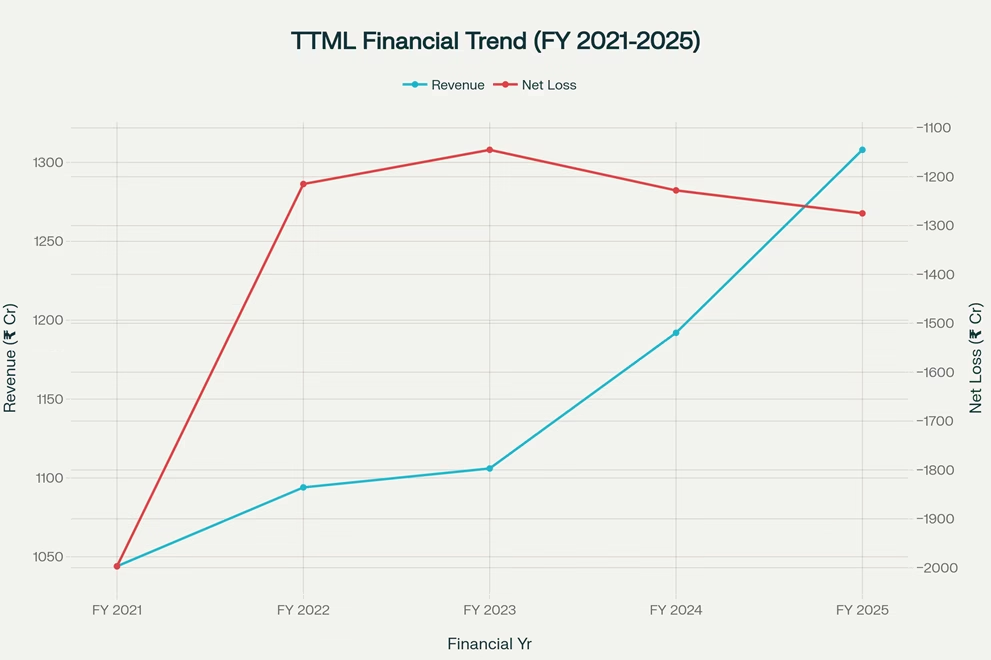

TTML shows modest revenue growth but persistent losses over 5-year period, indicating structural challenges

Revenue Performance:

- Total Income: Rs 286.36 करोड़ (-7.69% QoQ)

- Revenue from Operations: Rs 284.25 करोड़ (-12.13% YoY)

- Operating Performance: Despite revenue decline, operating margins improved to 50.96%

Profitability Challenges:

- Net Loss: Rs 324.98 करोड़ in Q1 FY26

- EPS: -Rs 1.66 per share (Basic)

- Interest Burden: Rs 432.89 करोड़ finance costs in quarter

- Net Margin: -112.99% indicating severe profitability issues

Historical Financial Trend Analysis

5-Year Performance Overview:

- FY21: Revenue Rs 1,044 करोड़, Net Loss Rs 1,997 करोड़

- FY22: Revenue Rs 1,094 करोड़, Net Loss Rs 1,215 करोड़

- FY23: Revenue Rs 1,106 करोड़, Net Loss Rs 1,145 करोड़

- FY24: Revenue Rs 1,192 करोड़, Net Loss Rs 1,228 करोड़

- FY25: Revenue Rs 1,308 करोड़, Net Loss Rs 1,275 करोड़

Key Observations:

- Revenue Growth: Modest 25% growth over 5 years (5% CAGR)

- Loss Pattern: Persistent losses ranging Rs 1,145-1,997 करोड़ annually

- Operating Margins: Consistently healthy 40-50% range

- Debt Accumulation: Continuous increase from Rs 19,429 करोड़ to Rs 20,342 करोड़

Major Financial Challenge: AGR Dues और Debt Burden

Debt Composition Analysis

Total Debt Structure (March 2025):

- Total Debt: Rs 20,342 करोड़ – massive burden

- AGR Dues: Rs 19,256 करोड़ (includes TTSL Rs 14,463 करोड़ + TTML Rs 3,367 करोड़)

- Payment Deadline: March 2026 for AGR dues settlement

- Non-cash Component: 60% of finance costs are non-cash nature

Debt Categories:

- Deferred Payment Liabilities: Largest component

- Compound Financial Instruments: Interest accrual on these instruments

- Working Capital: Commercial paper और financial lease obligations

- Accrued Interest: Accumulated interest on various debt instruments

Parent Support Mechanism

Tata Sons Backing:

- Historical Investment: Rs 46,595 करोड़ infused till June 2019

- Letter of Comfort: Ongoing support commitment from Tata Sons

- Potential Capital Infusion: May need fresh capital injection for AGR dues

- Group Strategy: Enterprise services fit within Tata Digital ecosystem

TTML: Market Position और Competitive Landscape

Enterprise Services Market Positioning

Competitive Advantages:

- Tata Brand: Trust और credibility in enterprise market

- Integrated Solutions: One-stop-shop for business ICT needs

- Local Presence: Strong Maharashtra और Goa market knowledge

- Technology Portfolio: Comprehensive digital transformation offerings

Market Challenges:

- Limited Geography: Operations restricted to 2 circles only

- Intense Competition: Large players like Airtel Business, Jio Business

- Technology Disruption: Cloud providers directly serving enterprises

- Pricing Pressure: Competitive rates affecting margins

Sector Comparison

Key Competitors Analysis:

- Bharti Airtel: Rs 11,72,770 करोड़ market cap, full-scale operations

- Vodafone Idea: Rs 72,807 करोड़ market cap, but also debt-stressed

- Tata Communications: Rs 47,606 करोड़ market cap, global enterprise focus

- Bharti Hexacom: Rs 87,088 करोड़ market cap, regional focus

TTML’s Relative Position:

- Market Cap: Rs 11,169 करोड़ – smallest among major telecom stocks

- Debt-to-Market Cap: Nearly 2:1 ratio – concerning leverage

- Business Focus: Niche enterprise services vs full telecom operations

- Growth Potential: Limited by geographic और service scope

Recent Developments और Strategic Initiatives

Product Innovation और Service Enhancement

New Service Launches:

- Smartflo Platform: WhatsApp business communication suite

- Smart Internet Leased Line: Bundled ILL with cloud security

- Ultra LOLA 2.0: Real-time market data processing for financial institutions

- Comprehensive Security Suite: Remote work security solutions

Technology Partnerships:

- Cloud Integration: Partnerships with major cloud service providers

- Digital Collaboration: Enhanced video conferencing और audio services

- IoT Solutions: Connected device management platforms

Management Changes और Corporate Governance

Recent Board Changes:

- Multiple director resignations और appointments in recent quarters

- Non-executive non-independent directors rotation

- Focus on strengthening governance structures

Investment Analysis और Risk Assessment

Valuation Metrics

Current Share Price Metrics:

- Share Price: Rs 57.13 (August 7, 2025)

- 52-Week Range: Rs 50.10 – Rs 104.00

- Market Cap: Rs 11,169 करोड़

- P/E Ratio: -8.75 (negative due to losses)

- P/B Ratio: -0.63 (negative book value)

- Beta: 1.12 (higher volatility than market)

TTML: Risk Factors

High-Risk Investment Considerations:

1. Financial Distress:

- Negative Net Worth: -Rs 17,876 करोड़ as reported

- Persistent Losses: 10+ years of continuous losses

- Debt Overhang: Rs 20,342 करोड़ total debt burden

- AGR Deadline: March 2026 payment pressure

2. Business Limitations:

- Geographic Restriction: Only Maharashtra और Goa operations

- Market Size: Limited addressable market vs national players

- Competition: Intense rivalry in enterprise services

- Technology Evolution: Rapid changes requiring continuous investment

3. Regulatory Challenges:

- AGR Disputes: Ongoing regulatory compliance issues

- Spectrum Obligations: Legacy spectrum liabilities

- License Conditions: Meeting rollout और performance obligations

Positive Factors

Investment Opportunities:

1. Parent Company Support:

- Tata Sons Backing: Strong financial support capability

- Brand Value: Tata name provides market credibility

- Strategic Fit: Part of Tata’s digital strategy

2. Niche Market Position:

- Enterprise Focus: Specialized B2B services

- Recurring Revenue: Long-term enterprise contracts

- High Margins: Operating margins consistently 40-50%

3. Digital Transformation Opportunity:

- Market Demand: Growing need for digital solutions

- Service Portfolio: Comprehensive ICT offerings

- Technology Partnerships: Access to latest platforms

Future Outlook और Strategic Direction

Business Strategy 2025-2027

Growth Initiatives:

- Service Diversification: Expanding cloud और security offerings

- Digital Platform Development: Enhanced Smartflo और collaboration tools

- Enterprise Partnerships: Strategic alliances with technology providers

- Geographic Expansion: Potentially exploring adjacent markets

Technology Roadmap:

- 5G Services: Preparing for next-generation enterprise applications

- AI Integration: Artificial intelligence in business solutions

- IoT Expansion: Connected enterprise solutions

- Cybersecurity Enhancement: Advanced security service offerings

Debt Resolution Strategy

Financial Restructuring Options:

- Asset Monetization: Spectrum trading opportunities

- Parent Infusion: Additional capital from Tata Sons

- Debt Restructuring: Negotiating payment terms with creditors

- Strategic Partnership: Potential joint ventures for growth

Investment Recommendation

Risk-Reward Assessment

High-Risk, Limited-Reward Profile:

Investment Rationale Against:

- Debt Overhang: Rs 20,342 करोड़ debt with March 2026 AGR deadline

- Negative Book Value: -Rs 91.02 per share indicates financial distress

- Persistent Losses: 10+ years of continuous losses despite revenue growth

- Limited Scalability: Geographic restriction to 2 circles only

- High Leverage: Debt-to-equity ratio extremely unfavorable

Conditional Investment Case:

- Tata Sons Support: Strong parent company backing

- Niche Positioning: Specialized enterprise services market

- Technology Assets: Valuable ICT platforms और solutions

- Brand Recognition: Tata brand value in enterprise segment

Investment Strategy

For Speculative Investors Only:

- Position Size: Maximum 1-2% of portfolio

- Investment Horizon: 3-5 years minimum for turnaround

- Entry Strategy: Dollar-cost averaging on significant dips

- Exit Triggers: Any sign of parent support withdrawal

For Conservative Investors:

- Recommendation: AVOID due to high financial risk

- Alternative: Consider Tata Communications for enterprise exposure

- Risk Assessment: Potential total loss of investment

Target Price Analysis

Bear Case: Rs 35-40 (debt restructuring scenario)

Base Case: Rs 50-60 (current trading range)

Bull Case: Rs 80-90 (successful turnaround with parent support)

Key Monitoring Points:

- AGR dues payment progress

- Tata Sons capital infusion decisions

- Quarterly revenue growth trends

- Enterprise market share gains

निष्कर्ष

Tata Teleservices (Maharashtra) Limited एक classic example है कि कैसे एक established telecom company अपने business model को completely transform कर सकती है। Consumer mobile business से enterprise services में shift करने के बावजूद, कंपनी अभी भी massive debt burden और persistent losses से जूझ रही है।

मुख्य निष्कर्ष:

Transformation Success:

- Consumer mobile exit से enterprise services focus तक successful transition

- Comprehensive ICT solutions portfolio development

- Strong operating margins despite revenue challenges

- Tata brand value और parent company support

Financial Challenges:

- Rs 20,342 करोड़ का debt burden with March 2026 AGR deadline

- 10+ years की persistent losses despite revenue growth

- Negative book value और poor financial ratios

- Limited geographic scope restricting scalability

Investment Perspective:

यह एक very high-risk, speculative investment है जो केवल उन investors के लिए suitable है जो:

- Tata Sons की support capacity पर भरोसा करते हैं

- Enterprise services market की growth potential देखते हैं

- Significant capital loss के risk को accept कर सकते हैं

- Long-term turnaround story में patience रख सकते हैं

Final Recommendation: केवल speculative investors के लिए small position के साथ। Conservative investors को avoid करना चाहिए क्योंकि financial distress का risk बहुत high है।

Investment Rating: ⭐⭐ (2/5) – High Risk, Limited Upside Potential

Disclaimer: यह analysis educational purpose के लिए है। Investment decisions से पहले professional financial advice लें और अपनी risk appetite consider करें।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”