Reliance Power शेयर प्राइस, भविष्य और निवेश सलाह 2025 || Invest करे या नहीं ??

Reliance Power Limited (RPOWER) अनिल अंबानी की flagship power generation कंपनी है जो वर्तमान में एक remarkable financial और strategic transformation के दौर से गुजर रही है। अगस्त 7, 2025 को कंपनी का शेयर प्राइस Rs 45.15 पर 5% lower circuit limit पर बंद हुआ है, जो Enforcement Directorate (ED) की Rs 17,000 करोड़ के alleged loan fraud case की जांच के कारण हुई volatility को दर्शाता है। हालांकि, इस regulatory uncertainty के बावजूद, कंपनी ने अपनी financial health में unprecedented improvement दिखाई है – zero debt status के साथ banks और financial institutions के साथ, Q1 FY26 में Rs 44.68 करोड़ का net profit, और 4+ GW का ambitious renewable energy pipeline।

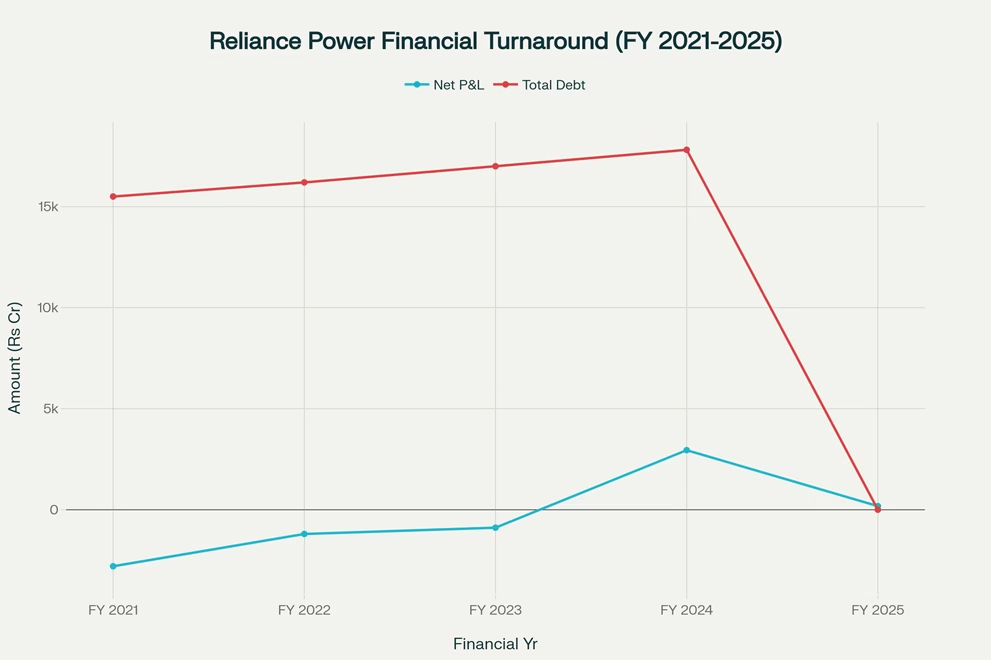

Reliance Power’s remarkable financial transformation from losses and high debt to profitability and zero debt status

Reliance Power: वर्तमान शेयर प्राइस और Market Dynamics

Current Market Position

Share Price Performance (August 2025):

- Current Price: Rs 45.15 (5% lower circuit)

- Market Cap: Rs 18,660 करोड़

- 52-Week High: Rs 76.49 (June 2025)

- 52-Week Low: Rs 29.21

- PE Ratio: 6.35 vs sector average

- PB Ratio: 1.21 (attractive valuation)

Recent Performance Analysis:

- 1 Week: -14.43% (due to ED probe concerns)

- 3 Months: +15.37% (pre-ED investigation)

- 6 Months: +7.84%

- 1 Year: +48.96% (impressive despite recent correction)

Volatility Due to ED Investigation

Reliance Power का शेयर अगस्त 2025 में ED probe के कारण consecutive lower circuits hit कर रहा है। Rs 17,000 करोड़ के alleged loan fraud case में Anil Ambani की 8+ hours की questioning और आगामी summons के कारण investor sentiment negative हो गई है।

ED Investigation Impact:

- Total Alleged Amount: Rs 17,000 करोड़ loan fraud

- Share Price Impact: -27% decline in August 2025

- Affected Companies: Reliance Home Finance, Commercial Finance, RCom

- Market Response: Panic selling और institutional exit

A speaker at a Reliance event discussing company matters, symbolizing Reliance Power’s corporate presence.

Reliance Power Financial Turnaround: एक Remarkable Recovery Story

Q1 FY26 Results – Profitability Return

Reliance Power ने Q1 FY26 में एक outstanding financial turnaround प्रदर्शित की है, जो debt restructuring strategy की सफलता को दर्शाती है।

Key Financial Highlights:

- Net Profit: Rs 44.68 करोड़ (vs loss Rs 97.85 करोड़ in Q1 FY25)

- Turnaround: +145.7% YoY improvement

- Total Income: Rs 2,025.31 करोड़ (-2.1% YoY)

- Revenue from Operations: Rs 1,885.58 करोड़ (-5.3% YoY)

- EBITDA: Rs 565 करोड़ for the quarter

- EPS: Rs 0.109 (vs -Rs 0.245 in Q1 FY25)

Operational Excellence:

- Sasan UMPP: ~91% Plant Load Factor consistently

- Rosa Power: ~97% availability factor

- Total Capacity: 5,305 MW operational portfolio

- Debt Service: Rs 584 करोड़ paid during quarter

Zero Debt Achievement – Historic Milestone

Complete Debt Restructuring Success:

- Previous Debt: Rs 17,812 करोड़ consolidated debt (June 2024)

- Current Status: Zero debt with banks और FIs on standalone basis

- Major Settlement: VIPL obligation Rs 3,872 करोड़ fully resolved

- Strategy: 100% shares of Vidarbha Industries pledged to CFM ARC

Rosa Power Debt Clearance:

- Amount Prepaid: Rs 850 करोड़ to Varde Partners

- Target: Complete debt-free status by FY25 end

- Capacity: 1,200 MW thermal plant in UP

Capital Infusion Strategy:

- Preferential Issue: Rs 1,525 करोड़ successfully completed

- Net Worth: Rs 16,431 करोड़ (substantial increase)

A night aerial view of Reliance Power’s Sasan thermal power plant in Madhya Pradesh, highlighting the plant’s infrastructure and chimney emitting smoke.

Power Generation Portfolio: World-Class Assets

Sasan Ultra Mega Power Project

World’s Largest Integrated Coal Plant:

- Capacity: 3,960 MW

- Location: Singrauli, Madhya Pradesh

- Performance: ~91% Plant Load Factor consistently

- Technology: Supercritical units with modern emission controls

- Fuel Security: Captive coal mines ensuring long-term supply

- Strategic Value: Cost-competitive baseload power generation

Key Advantages:

- Long-term Power Purchase Agreements (PPAs)

- Proximity to coal reserves reducing transportation costs

- Advanced pollution control technology

- Dedicated transmission infrastructure

Rosa Power Plant

High-Efficiency Thermal Generation:

- Capacity: 1,200 MW

- Location: Shahjahanpur, Uttar Pradesh

- Performance: ~97% availability factor

- Status: On track to become debt-free

- Grid Position: Strategic location in northern India

Operational Metrics:

- Consistent high availability levels

- Efficient fuel utilization ratios

- Strong grid connectivity

- Environmental compliance maintained

Renewable Energy Revolution: Future Growth Engine

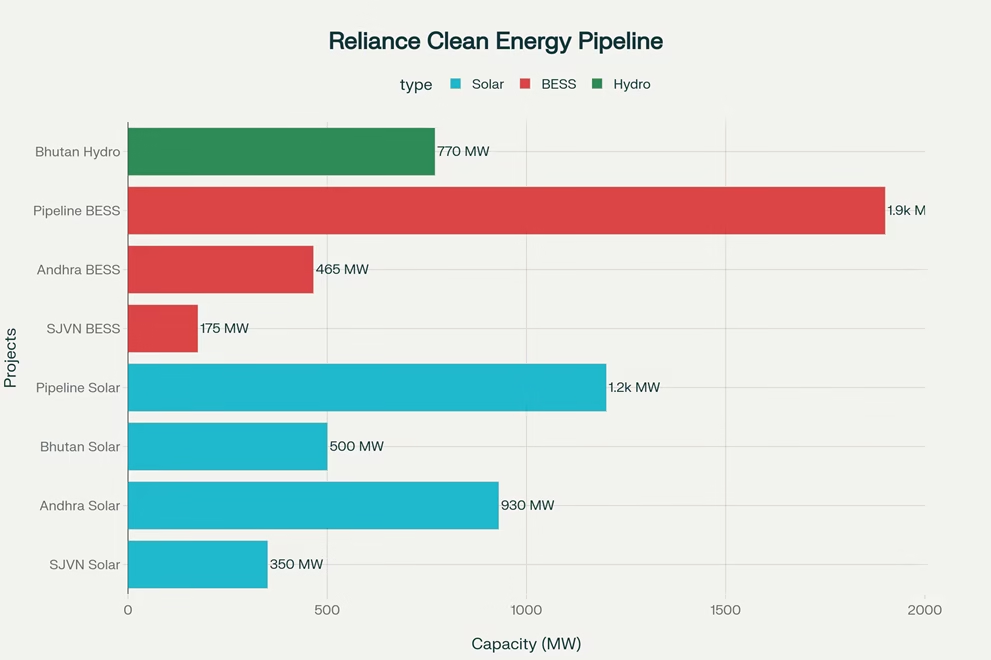

Reliance Power’s ambitious renewable energy pipeline totaling over 6 GW across solar, battery storage and hydroelectric projects

Massive Clean Energy Transformation

Reliance Power ने renewable energy sector में एक ambitious expansion strategy launch की है, जो इसे India’s largest integrated Solar + Battery Energy Storage System (BESS) player बनाती है।

Current Clean Energy Pipeline:

- Total Solar Pipeline: 2.4 GW DC capacity

- Battery Storage: 2.5+ GWh BESS capacity

- Market Position: #1 in integrated Solar + BESS segment

Major Renewable Projects Portfolio

1. SJVN Solar + BESS Project:

- Award Status: Letter of Award received from SJVN Ltd

- Capacity: 350 MW ISTS-connected solar + 175 MW/700 MWh BESS

- Tariff: Rs 3.33/kWh fixed for 25 years

- Competitive Edge: Won in oversubscribed tender (4x subscription)

- Technology: Dispatchable renewable energy solution

Project Significance:

- Build-Own-Operate (BOO) framework

- Minimum 4-hour daily discharge window

- Assured peak power delivery to DISCOMs

- 600 MW solar DC capacity deployment

2. Andhra Pradesh Mega Solar-BESS Project:

- Scale: Asia’s largest single-site integrated project

- Capacity: 930 MW solar + 465 MW/1,860 MWh BESS

- Investment: Rs 10,000 करोड़

- Location: Kurnool, Andhra Pradesh

- Tariff: Rs 3.53/kWh for 25 years

- Timeline: 24 months from PPA signing

Employment and Economic Impact:

- Direct Jobs: 1,000 permanent positions

- Construction Jobs: 5,000 during project phase

- Solar Deployment: 1,700+ MWp generation capacity

3. Solar Manufacturing Integration:

- Investment: Rs 6,500 करोड़

- Location: Near Visakhapatnam, Andhra Pradesh

- Land Requirement: ~1,500 acres in Rambili industrial area

- Strategy: Backward integration for solar panel manufacturing

Bhutan Strategic Partnership

India-Bhutan Energy Cooperation:

- Joint Venture: 50-50 partnership with Druk Holding & Investments (DHI)

- Investment Scale: Largest private investment in Bhutan’s renewable sector

- Strategic Significance: Cross-border energy cooperation

Project Components:

- Solar Project: 500 MW capacity

- Hydropower: 770 MW Chamkharchhu-I project

- Total Investment: Rs 2,000+ करोड़

- Benefits: Regional energy security और trade

International Gas Projects: Asset Monetization

Global Expansion Strategy

Reliance Power के पास valuable gas-based power generation assets हैं जो international deployment के लिए तैयार हैं।

Available Equipment Portfolio:

- Total Capacity: 1,500 MW (two modules of 750 MW each)

- Technology: General Electric (USA) world-class equipment

- Competitive Advantage: Ready for immediate deployment

- Market Gap: Global suppliers need 3-5 years for similar equipment

Active International Bidding

Target Markets और Projects:

- Kuwait: Gas-based power projects

- UAE: LNG-based power generation

- Malaysia: Clean energy initiatives

- Expected Realization: Up to Rs 2,000 करोड़

Previous Success:

- One 750 MW module exported to Bangladesh

- Partnership with Japan’s JERA

- Proven international execution capability

Strategic Benefits:

- Asset monetization for balance sheet improvement

- International market expansion

- Technology deployment expertise

- Revenue diversification

Indian Power Sector Context और Growth Outlook

Market Fundamentals और Demand Outlook

National Capacity Expansion:

- Current Installed: 536.23 GW (2025)

- Projected Capacity: 817.52 GW by 2030

- Growth Rate: 8.8% CAGR

- Peak Demand Forecast: 277.2 GW by 2026-27, 366.4 GW by 2031-32

Investment Requirements:

- Total Investment Need: Rs 33.6 trillion over next decade

- Renewable Target: 500 GW non-fossil fuel by 2030

- Coal Capacity: Expected to grow by 80 GW to 2031-32

- Nuclear Expansion: 100 GW target by 2047

Renewable Energy Growth Drivers

Government Policy Support:

- 100% FDI allowed in power sector

- Production-Linked Incentive (PLI) schemes

- Viability Gap Funding (VGF) for projects

- Grid modernization initiatives

Market Dynamics:

- Solar Growth: From 66.78 GW (2022-23) to 100.33 GW (2024-25)

- Wind Capacity: 48.37 GW current installed

- BESS Demand: Growing for grid stability

- Private Investment: Strong participation encouraged

Electricity Demand Growth:

- Annual Growth: ~5% expected till 2040

- GDP Correlation: 7% GDP growth supporting demand

- Sectoral Drivers: Manufacturing, urbanization, electrification

ED Investigation: Current Legal Challenges

Investigation Details और Timeline

Case Overview:

- Total Amount: Rs 17,000 करोड़ alleged loan fraud

- Primary Companies: Reliance Home Finance, Commercial Finance, RCom

- Time Frame: Transactions dating back 8+ years

- Banks Affected: Nearly 20 lenders including YES Bank

ED Actions और Process:

- Raids Conducted: July 24-27, 2025 across 35 locations

- Scope: 50 companies, 25 individuals questioned

- Anil Ambani Questioning: 8+ hours, multiple sessions

- Documents: Large volume of evidence allegedly recovered

Allegations Structure

Key Allegations:

- Quid Pro Quo: Arrangements with YES Bank officials

- Shell Companies: Investments routed through suspicious entities

- Fake Guarantees: Rs 68 करोड़ bank guarantee to SECI

- Fund Diversion: Complex transaction patterns

Specific Cases:

- YES Bank Loans: Rs 3,000 करोड़ allegedly diverted

- Common Addresses: Borrowers sharing same locations

- Weak Financials: Entities lacking proper documentation

- Related Party Transactions: Fund flows to group companies

Company Response और Defense

Official Clarifications:

- Timeline: Investigation relates to 8+ year old matters

- Loan Status: All questioned loans fully repaid

- Current Health: Companies “nearly debt-free”

- Governance: Anil Ambani not board member since March 2022

Financial Position Emphasis:

- Reliance Power Net Worth: Rs 16,431 करोड़

- Reliance Infrastructure Net Worth: Rs 14,883 करोड़

- Debt Status: Zero debt with banks और FIs

- Operational Health: Strong performance metrics

Technical Analysis और Investment Perspective

Valuation Assessment

Current Valuation Metrics:

- P/E Ratio: 6.35 vs sector average of ~26

- P/B Ratio: 1.21 (reasonable compared to book value)

- EV/EBITDA: Attractive due to zero debt

- Dividend Yield: Currently nil but potential for resumption

Historical Performance:

- 3-Year CAGR: 52.87% (pre-ED investigation)

- 5-Year CAGR: 66.27% (exceptional recovery)

- Peak Performance: Rs 76.49 in June 2025

- Recovery: From Rs 1.2 (2020) to Rs 76 (2025 peak)

Risk-Reward Analysis

Positive Investment Drivers:

1. Financial Transformation:

- Zero debt achievement – unprecedented in recent history

- Return to profitability in Q1 FY26

- Strong operational metrics at both plants

- Robust net worth of Rs 16,431 करोड़

2. Growth Visibility:

- 4+ GW renewable pipeline with confirmed projects

- Asia’s largest solar-BESS project under development

- International expansion opportunities worth Rs 2,000 करोड़

- Strategic partnerships in Bhutan

3. Market Position:

- #1 player in integrated Solar + BESS segment

- World’s largest coal plant (Sasan) with excellent performance

- Proven execution capability in complex projects

- Strong relationships with government entities

4. Sector Tailwinds:

- India’s 500 GW renewable target by 2030

- 8.8% CAGR growth in power capacity

- Government support for clean energy transition

- Rising electricity demand at 5% annually

Risk Factors:

1. Regulatory Challenges:

- ED investigation creating uncertainty

- Potential legal consequences for promoter

- SECI debarment (though subsequently withdrawn)

- Corporate governance concerns

2. Market Risks:

- Power demand fluctuations

- Technology obsolescence in thermal plants

- Competition in renewable space

- Policy changes affecting power sector

3. Execution Risks:

- Large project delivery challenges

- Timeline delays in renewable projects

- Technology integration complexities

- Financing arrangements for expansion

4. Promoter Issues:

- Anil Ambani’s legal challenges

- Low promoter holding percentage

- Succession planning concerns

- Market perception overhang

Investment Recommendation और Strategy

Investment Thesis

Conditional BUY Recommendation – Target Price: Rs 65-70 (12-18 months)

Core Rationale:

- Historic Financial Recovery: From Rs 17,812 करोड़ debt to zero debt status

- Operational Excellence: 91% PLF at Sasan, 97% availability at Rosa

- Growth Pipeline: 4+ GW renewable projects with locked-in tariffs

- Valuation Opportunity: P/E of 6.35 vs sector average 26

- Sector Leadership: #1 in Solar + BESS segment

Key Success Factors:

- Legal Clarity: ED case resolution without major penalties

- Project Execution: On-time delivery of Andhra Pradesh mega project

- Asset Monetization: International gas project deployment

- Market Recovery: Investor confidence restoration

Phased Investment Approach

Phase 1 – Current Distressed Levels (Rs 45-50):

- Allocation: 30-40% of intended investment

- Rationale: Maximum pessimism priced in

- Risk: High due to legal uncertainty

- Timeline: Next 3-6 months

Phase 2 – Legal Clarity Emerges (Rs 50-60):

- Allocation: 40-50% of intended investment

- Trigger: Positive development in ED case

- Risk: Medium as overhang reduces

- Timeline: 6-12 months

Phase 3 – Project Milestones (Rs 60-70):

- Allocation: Remaining 10-20%

- Catalyst: Renewable project commissioning

- Risk: Lower with execution delivery

- Timeline: 12-24 months

Portfolio Strategy Guidelines

Conservative Investors:

- Maximum Allocation: 2-3% of total portfolio

- Entry Strategy: Small positions, dollar-cost averaging

- Holding Period: 3-5 years minimum

- Exit Strategy: Gradual profit booking above Rs 75

Aggressive Investors:

- Maximum Allocation: 5-8% of portfolio

- Entry Strategy: Accumulate on sharp dips

- Trading Component: 30% for short-term, 70% long-term

- Stop Loss: Rs 38 (major technical support)

Monitoring Parameters

Short-term (3-6 months):

- ED investigation progress और outcomes

- Q2 FY26 financial results

- SJVN project execution milestones

- Share price technical levels

Medium-term (6-18 months):

- Andhra Pradesh project commissioning

- International gas project awards

- Financial performance consistency

- Market sentiment recovery

Long-term (2-5 years):

- Renewable vs thermal capacity mix evolution

- Regional expansion in South Asia

- Technology leadership in BESS

- ESG compliance और sustainability metrics

भविष्य की रणनीति और Growth Roadmap

Strategic Vision 2030

Business Transformation Targets:

- Capacity Mix: 50-50 renewable-thermal portfolio

- Market Position: Top 3 in Indian integrated energy player

- Geographic Reach: Strong presence in South Asian energy corridor

- Technology Leadership: Advanced BESS और smart grid capabilities

Revenue Diversification:

- Power generation (60-70%)

- International projects (15-20%)

- Energy storage services (10-15%)

- Green hydrogen (future opportunity)

Key Strategic Initiatives

1. Renewable Energy Scale-up:

- Commission 4+ GW renewable capacity by 2027

- Develop manufacturing capabilities for backward integration

- Explore floating solar और agri-voltaic projects

- Partner with global technology providers

2. International Expansion:

- Deploy gas assets in Kuwait, UAE, Malaysia

- Explore opportunities in Bangladesh, Sri Lanka

- Develop regional energy trading capabilities

- Build cross-border transmission partnerships

3. Technology Innovation:

- Advanced battery storage technologies

- Grid-scale energy management systems

- Digital twins for power plant optimization

- AI-driven maintenance protocols

4. Financial Optimization:

- Maintain zero debt status with banks

- Explore green bonds for renewable funding

- Develop InvIT structure for asset monetization

- Implement robust risk management systems

निष्कर्ष और Final Assessment

Reliance Power एक compelling investment story प्रस्तुत करती है जो significant transformation, substantial opportunities, और current challenges के unique combination के साथ आती है। ED investigation के कारण short-term volatility के बावजूद, कंपनी की fundamental business metrics में remarkable improvement आई है।

Investment Highlights:

Financial Renaissance:

- Historic Achievement: Rs 17,812 करोड़ से zero debt – unprecedented turnaround

- Profitability Recovery: Q1 FY26 में Rs 45 करोड़ profit vs previous losses

- Operational Excellence: 91% PLF at Sasan, 97% availability at Rosa

- Strong Balance Sheet: Rs 16,431 करोड़ net worth

Future-Ready Portfolio:

- Clean Energy Leadership: 4+ GW renewable pipeline

- Technology Advantage: #1 in Solar + BESS integrated segment

- International Expansion: Rs 2,000 करोड़ monetization potential

- Strategic Partnerships: Bhutan JV for regional presence

Market Positioning:

- Sector Tailwinds: India’s 500 GW renewable target by 2030

- Demand Growth: 5% annual electricity demand increase

- Government Support: Policy backing for clean energy transition

- Competitive Advantage: Ready equipment vs 3-5 year delivery times

Key Risk Mitigation:

- Diversified Revenue: Thermal + renewable + international

- Long-term Contracts: 25-year PPAs providing revenue visibility

- Operational Track Record: Proven execution in mega projects

- Strategic Assets: World-class power generation facilities

Final Verdict:

Reliance Power represents a rare turnaround opportunity in the Indian power sector. While ED investigation creates short-term uncertainty, the company’s fundamental transformation from a debt-laden entity to a profitable, debt-free renewable energy leader cannot be ignored.

Investors should adopt a selective and phased approach, taking advantage of current pessimism while being mindful of regulatory risks. The stock offers significant upside potential for those willing to navigate short-term volatility and believe in India’s clean energy transformation story.

Key Message: “Reliance Power – From Financial Distress to Clean Energy Leadership, A Transformation Worth Investing In”

यह निवेश उन investors के लिए suitable है जो India की energy transition story में participate करना चाहते हैं और regulatory challenges को navigate करने की patience रखते हैं।

Disclaimer: यह analysis educational purpose के लिए है। Investment decisions से पहले professional financial advice लें और अपनी risk appetite consider करें।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”