Mankind Pharma शेयर प्राइस, भविष्य और निवेश सलाह 2025 : Mankind Pharma में निवेश करें या नहीं ?

Mankind Pharma Limited (MANKIND) भारतीय फार्मासिटिकल इंडस्ट्री की एक प्रमुख सफलता की कहानी है जो निवेशकों के लिए महत्वपूर्ण अवसर प्रदान करती है। अप्रैल 2023 में Rs 1,080 की IPO प्राइस के साथ stock exchanges में सूचीबद्ध होने के बाद, कंपनी का शेयर प्राइस वर्तमान में Rs 2,556-2,619 के स्तर पर ट्रेड कर रहा है, जो IPO से लगभग 137% की वृद्धि दर्शाता है। Rs 1,05,502 करोड़ के market capitalization के साथ, Mankind Pharma ने prescription medicines में #1 रैंकिंग हासिल करके अपनी मजबूत market position स्थापित की है। Q1 FY26 में कंपनी ने Rs 3,570 करोड़ का consolidated revenue दर्ज किया है, जो 24.5% YoY growth दर्शाता है, हालांकि BSV acquisition के कारण financing costs बढ़ने से net profit में 17.4% की गिरावट देखी गई है।

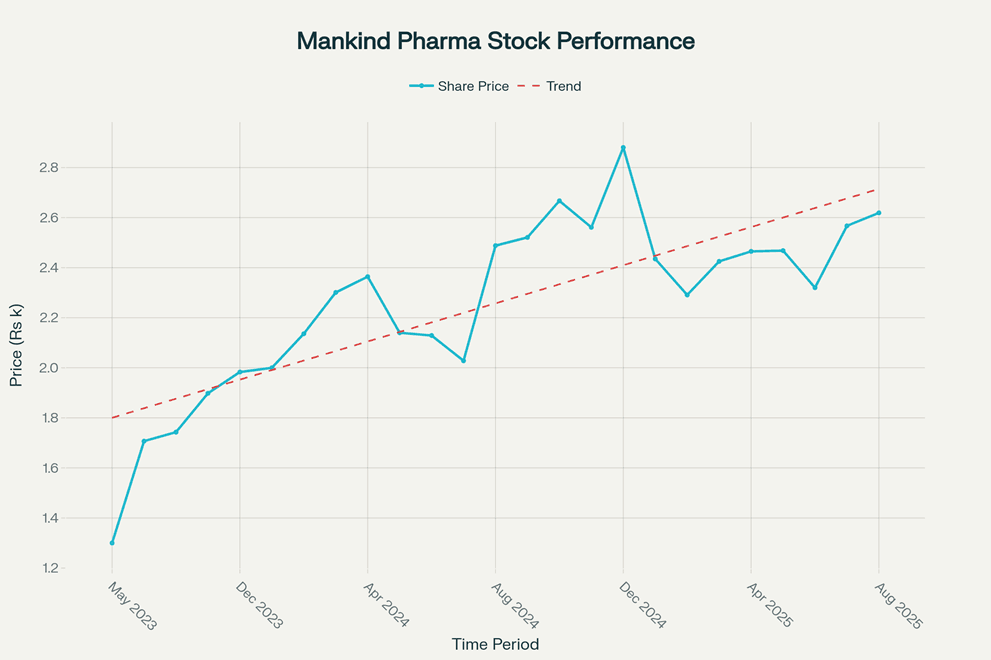

Mankind Pharma stock price performance from IPO listing in May 2023 to August 2025

कंपनी का परिचय और इतिहास

स्थापना और विकास यात्रा

Mankind Pharma Limited की स्थापना 3 जुलाई 1991 को एक private limited company के रूप में हुई थी, जिसका प्रारंभिक नाम Mankind Pharma Private Limited था। दिल्ली और हरियाणा के Registrar of Companies में registered यह कंपनी 2005 में public limited company में convert हो गई और 13 अप्रैल 2006 को नया certificate of incorporation जारी हुआ।

कंपनी के founder और current Chairman श्री Rajeev Juneja तथा Vice Chairman & Managing Director के रूप में कार्यरत हैं। 30+ वर्षों की यात्रा में Mankind Pharma ने भारतीय pharmaceutical market में अपनी एक अलग पहचान बनाई है।

मुख्य उपलब्धियां और मील के पत्थर

Market Leadership:

- #1 in Prescriptions – लगातार 7+ सालों से prescription volume में शीर्ष स्थान

- #3 by Volume – भारतीय pharmaceutical market में volume के हिसाब से तीसरी सबसे बड़ी कंपनी

- #4 by Value – value के आधार पर चौथी सबसे बड़ी pharmaceutical company

Business Expansion:

- 2004 में chronic pharmaceutical segment में प्रवेश Amlokind tablets और Glimestar tablets के साथ

- 500+ products का विविधतापूर्ण portfolio various acute और chronic therapeutic areas में

- 21 manufacturing facilities pan-India में advanced technology के साथ

Recent Strategic Moves:

- अक्टूबर 2024 में Bharat Serums & Vaccines (BSV) का Rs 13,768 करोड़ में acquisition

- Consumer healthcare segment में Manforce, Prega News जैसे popular brands की सफलता

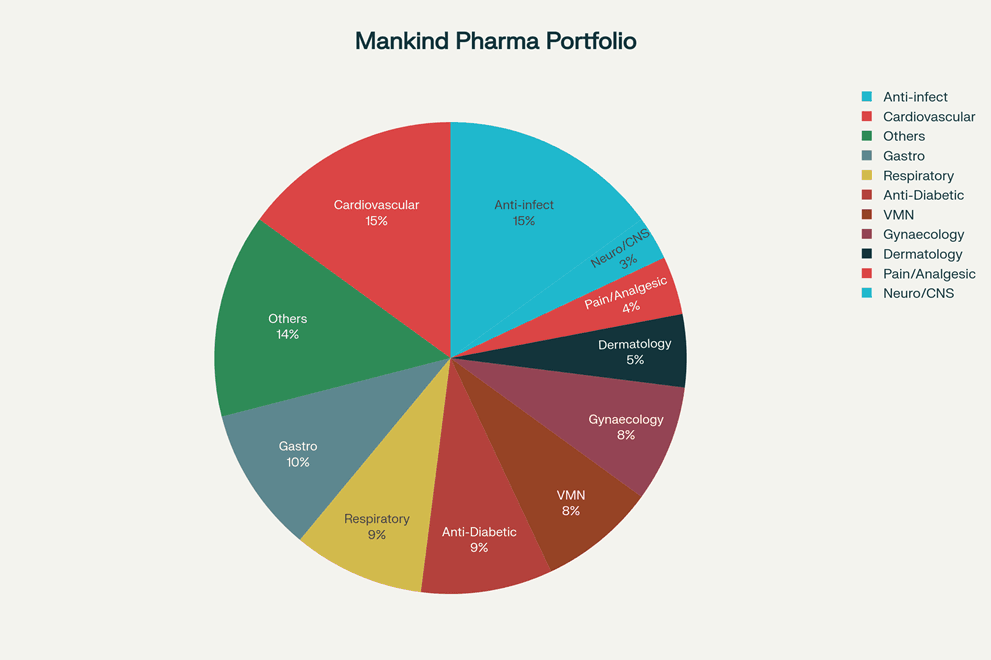

Breakdown of Mankind Pharma’s therapeutic portfolio by percentage of domestic sales

व्यापारिक मॉडल और राजस्व धाराएं

मुख्य व्यापारिक गतिविधियां

Mankind Pharma का business model multi-pronged approach पर आधारित है:

1. Pharmaceutical Formulations (मुख्य व्यापार):

- Generic और branded medications का निर्माण और विपणन

- Acute और chronic therapeutic areas में 500+ products

- Domestic market में strong presence के साथ international expansion

2. Consumer Healthcare:

- Manforce condoms – market leading brand

- Prega News – pregnancy test kit

- Gas-O-Fast – antacid brand

- इस segment में 15% YoY growth Q1 FY26 में

3. Research & Development:

- FY24 में Rs 223 करोड़ का R&D investment

- 660+ scientists का team including 60 PhD holders

- 109 new molecules under development pipeline में

- 6 R&D facilities across India

Revenue Streams विश्लेषण

Domestic Sales (मुख्य revenue source):

- Q1 FY26 में domestic revenue Rs 3,101 करोड़ (18.9% YoY growth)

- Chronic therapies में IPM को 1.4x outperform

- Cardiac और anti-diabetic segments में 1.5x और 1.6x faster growth

Export Business:

- Q1 FY26 में exports में 81% YoY growth – remarkable performance

- 100+ countries में presence

- BSV integration के साथ global operations में expansion

Therapeutic Segment Breakdown:

- Anti-infectives: 15% of domestic sales – respiratory और infection management

- Cardiovascular: 15% – Amlokind, Glimestar जैसे blockbuster brands

- Gastrointestinal: 10% – digestive health solutions

- Anti-Diabetic: 9% – diabetes management portfolio

- Respiratory: 9% – breathing और lung health

वित्तीय प्रदर्शन और विश्लेषण

वर्तमान वित्तीय स्थिति

Share Price Performance:

- Current Price: Rs 2,556-2,619 (August 2025)

- IPO Price: Rs 1,080 (April 2023)

- Listing Price: Rs 1,300 (May 2023)

- 52-Week High: Rs 3,054.80 (December 2024)

- 52-Week Low: Rs 2,000

- Return from IPO: +137% impressive performance

Q1 FY26 Financial Highlights:

- Consolidated Revenue: Rs 3,570 करोड़ (24.5% YoY growth)

- Net Profit: Rs 445 करोड़ (-17.4% YoY decline)

- EBITDA: Rs 850 करोड़ (26.1% YoY growth)

- EBITDA Margin: 23.8% (improved from 23.6%)

Key Financial Ratios:

- P/E Ratio: 54.88-57.06 (premium valuation)

- P/B Ratio: 7.33-7.42 (higher than sector average)

- Book Value: Rs 347 per share

- Market Cap: Rs 1,05,502 करोड़

- ROE: 14.7% (above sector average)

- ROCE: 16.0% (healthy returns)

Revenue Trend Analysis

Historical Revenue Growth:

- FY22: Rs 7,782 करोड़

- FY23: Rs 8,749 करोड़

- FY24: Rs 10,260 करोड़

- FY25: Rs 12,207 करोड़

- TTM: Rs 12,925 करोड़

यह data consistent double-digit growth दर्शाता है with strong momentum.

Profitability Trends:

- Operating Profit Margin: 25% consistently maintained

- Net Profit Margin: 15-20% range में stable

- EBITDA Margin: 23-25% range – industry-leading margins

BSV Acquisition का प्रभाव

Strategic Rationale:

- Women’s health, fertility, और critical care segments में entry

- High-entry barrier segments जहां competition limited है

- BSV’s established global presence का leverage

Financial Impact:

- Q1 FY26 में significant revenue contribution

- Finance costs में sharp increase due to acquisition financing

- Integration benefits expected in coming quarters

Mankind Pharma manufacturing facility showcasing the company’s infrastructure.

Indian Pharmaceutical Market Context

Market Size और Growth Prospects

Current Market Dynamics:

- Indian Pharma Market (IPM): Rs 2.17 trillion (MAT September 2024)

- Growth Rate: 7.8% YoY (April 2025)

- Volume Growth: 1.3% YoY (price-driven growth)

- Chronic vs Acute: Chronic therapies growing 9-10% vs Acute 6%

Global Context:

- India is #3 by volume और #14 by value globally

- 20% of global generic drug supply से India आता है

- $58 billion current market projected to reach $120-130 billion by 2030

- $450 billion by 2047 – massive growth opportunity

Export Performance:

- FY24 Exports: $27.9 billion (9.67% growth)

- US Market: 40% of US generic drug market supplied by India

- UK Market: 25% market share in UK

- Growth Rate: 9% annually vs 5% global average

Therapeutic Trends

Chronic Therapy Dominance:

- Cardiovascular diseases leading cause of death (28.1%)

- Diabetes, hypertension की बढ़ती prevalence

- Aging population driving chronic disease demand

Key Growth Drivers:

- Pricing: 4.3% contribution to IPM growth

- New Launches: 2.3% contribution

- Volume: 1.3% contribution

Therapy-wise Performance (April 2025):

- Cardiac: 10-11% YoY growth on Rs 30,000+ crore base

- Gastrointestinal: 7% value growth

- Anti-diabetic: 5-6% value growth despite price erosion

- Urology: 11.8% growth

Competitive Landscape

Market Position विश्लेषण

Mankind की Competitive Advantages:

1. Scale और Reach:

- 16,000+ field force – among largest in industry

- 13,000+ stockists nationwide distribution

- 75 CFAs (Clearing & Forwarding Agents)

- 1,50,000+ retail outlets reach

2. Brand Portfolio:

- 500+ products across therapeutic areas

- 23 brands generating Rs 100+ crore revenue each

- 11 brands with Rs 200+ crore revenue

- Strong brand recall in chronic segments

3. Manufacturing Excellence:

- 21 manufacturing facilities across India

- cGMP और FDA guidelines compliance

- Advanced technologies for sterile preparations

- 99.9% network uptime delivery record

4. R&D Capabilities:

- 660+ scientists including 60 PhD holders

- 6 R&D facilities with cutting-edge infrastructure

- 109 new molecules in development pipeline

- Focus on NCEs (New Chemical Entities)

Key Competitors Comparison

Top Indian Pharma Companies (FY24 Revenue):

- Sun Pharma – Market leader

- Dr. Reddy’s – Strong international presence

- Aurobindo Pharma – Export-focused

- Mankind Pharma – #4 position by value

- Cipla – Global footprint

Mankind vs Competitors:

- Prescription Leadership: #1 for 7+ years consecutively

- Volume Growth: Consistently outpacing IPM

- Chronic Focus: Higher chronic share (37.1%) vs industry

- Cost Leadership: Lowest employee costs in industry

- Cash Cycle: Shortest working capital cycle

BSV Acquisition: एक Game-Changing Move

Strategic Rationale

BSV Profile:

- Established in 1971 – 50+ years experience

- Renowned for biological और biotech formulations

- Specialization in women’s health, fertility, critical care

- Strong international presence और regulatory approvals

Acquisition Benefits:

- High-Entry Barrier Segments: Women’s health में limited competition

- Premium Pricing: Specialty products command better margins

- Global Expansion: BSV’s established international network

- Technology Access: Advanced biotech manufacturing capabilities

Financial Implications

Acquisition Details:

- Deal Size: Rs 13,768 करोड़ (largest Indian pharma acquisition 2024)

- Funding: Debt financing through leading banks

- Integration: October 2024 से consolidation शुरू

Q1 FY26 Impact:

- Revenue Boost: Significant contribution to 24.5% growth

- Margin Dilution: Integration costs affecting short-term margins

- Finance Costs: Sharp increase due to debt financing

- Long-term Value: Expected synergies और market expansion

Growth Strategy और Future Outlook

Strategic Focus Areas

1. Chronic Therapy Expansion:

- Current share: 37.1% (up from 18% in FY18)

- Target: Further increase chronic portfolio share

- Focus areas: Cardiovascular, diabetes, respiratory

2. Innovation Pipeline:

- 109 molecules under development

- Anti-diabetic NCE in Phase I clinical trials

- Autoimmune diseases और NASH – pre-clinical stage

- Investment in cutting-edge research

3. International Expansion:

- Current exports growth: 81% YoY in Q1 FY26

- Presence in 100+ countries

- Focus on regulated markets for higher margins

- BSV integration boosting global reach

4. Digital Transformation:

- 16,000+ field force digitization

- E-commerce partnerships growing contribution

- Modern trade channels expansion

- AI और data analytics adoption

Market Opportunities

1. Indian Market Growth:

- IPM projected 7-8% CAGR in medium term

- Chronic therapy demand driven by lifestyle diseases

- Rural market penetration through government initiatives

2. Global Export Potential:

- $350 billion export target by 2047 for Indian pharma

- Supply chain diversification away from China

- Biosimilars opportunity in developed markets

- CDMO/CRO services expansion

3. Regulatory Tailwinds:

- PLI scheme benefits for domestic manufacturing

- API self-reliance initiatives

- Quality focus improving global acceptance

Investment Analysis

Valuation Metrics

Current Valuation:

- P/E Ratio: 54.88 vs sector average 44.39

- P/B Ratio: 7.33 vs sector average 4-6

- EV/EBITDA: Premium to peers

- Price/Sales: Higher than competitors

Valuation Justification:

- Consistent growth in revenue और market share

- Market leadership in prescriptions

- Strong brand portfolio with pricing power

- BSV acquisition providing new growth avenues

- Innovation pipeline promising future products

Risk Factors

Company-Specific Risks:

- BSV Integration Challenges: Complex merger process

- High Debt: Acquisition financing increasing leverage

- Margin Pressure: Competition और pricing pressures

- Key Person Risk: Dependence on promoter leadership

Industry Risks:

- Regulatory Changes: NLEM price controls

- API Dependency: Import reliance on China

- Competition: New players और price wars

- Currency Fluctuation: Export revenue volatility

Market Risks:

- Economic Slowdown: Healthcare spending impact

- Policy Changes: Government healthcare policies

- Global Trade: Export market uncertainties

Investment Recommendation

Positive Factors:

- Strong Market Position: #1 in prescriptions consistently

- Diversified Portfolio: Balanced acute-chronic mix

- Growth Strategy: BSV acquisition expanding opportunities

- Financial Health: Strong balance sheet pre-acquisition

- Market Tailwinds: Indian pharma growth prospects

Concerns:

- Premium Valuation: High P/E और P/B ratios

- Short-term Margin Pressure: BSV integration costs

- Debt Increase: Financing burden from acquisition

Target Investor Profile:

- Growth-oriented investors seeking pharma exposure

- Long-term horizon (3-5 years minimum)

- Risk tolerance for premium valuations

- Sector understanding of pharma business cycles

निष्कर्ष और सुझाव

मुख्य निष्कर्ष

Mankind Pharma भारतीय pharmaceutical industry की एक प्रमुख success story है जो अपनी market leadership, innovative approach, और strategic acquisitions के through sustainable growth deliver कर रही है। कंपनी का IPO से अब तक का +137% return और consistent financial performance इसकी fundamental strength को दर्शाता है।

Key Strengths:

- Market Leadership – #1 prescription ranking for 7+ years

- Diversified Portfolio – 500+ products across therapeutic areas

- Strong Distribution – 16,000+ field force और extensive reach

- Innovation Focus – Rs 223 करोड़ R&D investment और 109 molecules pipeline

- Strategic Acquisitions – BSV deal expanding into high-margin segments

Growth Catalysts:

- Chronic Therapy Expansion से premium margins

- Export Growth – 81% YoY growth momentum

- BSV Integration benefits materializing

- Indian Pharma Market growth at 7-8% CAGR

- Global Export Opportunities worth $350 billion by 2047

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

Also Read :

NTPC Green Energy में निवेश करें या नहीं? क्या यह अगला मल्टीबैगर है?2025

ONGC का भविष्य: 2025 में ग्रोथ, चैलेंज और अपॉर्च्युनिटी का एनालिसिस