Adani Power Ltd Share Analysis 2025 | Stock Split Guide & Investment Strategy Hindi

Adani Power Limited (APL) भारत की सबसे बड़ी private sector thermal power producer है जो 18,150 MW की installed capacity के साथ country के energy security में crucial role निभा रही है। यह कंपनी Adani Group की flagship power arm है और August 2025 में company ने अपना first-ever 1:5 stock split announce किया है, जो retail investors के लिए एक significant development है।

Adani Power: कंपनी का परिचय और Business Model

Historical Background और Evolution

Adani Power की शुरुआत 1996 में एक power trading company के रूप में हुई थी। Company का major transformation 2009 में आया जब इसने अपनी पहली 330 MW capacity को Mundra में commission किया। तब से company ने एक remarkable journey दिखाया है:

Key Milestones:

- 2009: First 330 MW unit commissioning

- 2010: India’s first supercritical 660 MW unit

- 2012: Mundra TPP completion (4,620 MW) – world’s largest private thermal plant

- 2014: Largest private power producer status achieved (9,280 MW)

- 2025: Current capacity 18,150 MW with 13,120 MW under construction

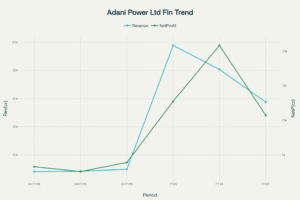

Adani Power financial performance showing revenue stability but profit volatility over recent periods

Adani Power operates on a diversified revenue model که multiple income streams provide करती है:

1. Long-term Power Purchase Agreements (87% capacity)

- Fixed rate contracts with state governments

- Predictable cash flows और revenue visibility

- Contracts with Gujarat, Maharashtra, Haryana, Rajasthan, Karnataka, Punjab

- Average contract duration: 25 years

2. Short-term PPAs (8% capacity)

- Medium-term contracts (1-5 years)

- Flexible pricing mechanisms

- Seasonal demand adjustment capability

3. Merchant Sales (5% capacity)

- Market-based pricing

- Higher margins during peak demand

- Spot market opportunities

Power Plant Portfolio और Geographic Spread

Adani Power का extensive portfolio 6 states में फैला हुआ है:

Operational Plants:

- Mundra (Gujarat): 4,620 MW (largest single-location coal plant)

- Tiroda (Maharashtra): 3,300 MW

- Kawai (Rajasthan): 1,320 MW

- Udupi (Karnataka): 1,200 MW

- Godda (Jharkhand): 1,600 MW (exports to Bangladesh)

Under Construction:

- Raipur (Chhattisgarh): 1,600 MW

- Raigarh (Chhattisgarh): 1,600 MW

- Korba (Chhattisgarh): 1,320 MW + 1,600 MW

- Singrauli-Mahan (Madhya Pradesh): 1,600 MW

- Mirzapur (Uttar Pradesh): 1,600 MW

- Recent additions: Bihar (2,400 MW) और UP (1,500 MW) projects won

Management Leadership और Strategic Vision

CEO: S.B. Khyalia – Experienced Leadership

Professional Profile:

- Appointment: January 11, 2022 as CEO

- Experience: 32+ years in power industry

- Qualification: Chartered Accountant

- Previous Role: Managing Director, Gujarat Power Corporation

- Expertise: Power trading, legal & regulatory, PPA management

Key Leadership Qualities:

- Deep understanding of renewable और thermal power sectors

- Experience in ultra-mega renewable park development

- Strong regulatory और commercial expertise

- Board positions in multiple power companies including Power Exchange India Ltd

Strategic Vision 2030

Under S.B. Khyalia’s leadership, company का clear roadmap है:

- Target Capacity: 30,670 MW by 2030

- Current Pipeline: 13,120 MW under construction

- Focus: Ultra-supercritical technology deployment

- Sustainability: Low emission, high efficiency plants

Financial Performance Analysis

Q1 FY26 Results: Mixed Performance

Key Financial Highlights:

- Total Revenue: ₹14,109.15 crore (5.7% YoY decline)

- Net Profit: ₹3,305.13 crore (15.5% YoY decline)

- EBITDA: ₹5,744 crore (8.7% YoY decline)

- EBITDA Margin: 40.7%

- EPS: ₹7.94 (vs ₹9.21 in Q1 FY25)

Performance Drivers और Challenges

Positive Factors:

- Power Sales Volume: 24.6 BU (1.6% YoY growth despite high base)

- Sequential Improvement: 27.2% QoQ profit growth from Q4 FY25

- PLF: Maintained at 78% (industry leading)

- Bangladesh Payments: $500+ million overdue payments received

Challenges:

- Lower merchant tariffs impact

- Higher operating expenses from acquisitions

- Early monsoon demand disruption

- One-time costs from Vidarbha acquisition

Multi-year Financial Trend

Revenue Growth:

- FY25: ₹58,906 crore (17% growth)

- FY24: ₹50,351 crore (30% growth)

- FY23: ₹38,773 crore

- 5-year Revenue CAGR: 16%

Profitability Volatility:

- FY24: ₹20,829 crore (exceptional performance)

- FY25: ₹12,750 crore (39% decline)

- FY23: ₹10,727 crore

Key Financial Ratios और Metrics

- Current Price: ₹584.05

- Market Cap: ₹2,25,265 crore

- P/E Ratio: 18.15 (reasonable for power sector)

- P/B Ratio: 4.47

- ROE: 25.7% (excellent returns)

- Debt-to-Equity: 0.8 (moderate leverage)

- Book Value: ₹146 per share

Stock Split 2025: Game Changer for Retail Investors

Stock Split Details

Historic First Split:

- Ratio: 1:5 (first-ever stock split)

- Implementation: Subject to shareholder approval

- Record Date: To be announced post approval

- Face Value Change: ₹10 → ₹2 per share

- Share Count: 2,480 crore → 12,400 crore shares

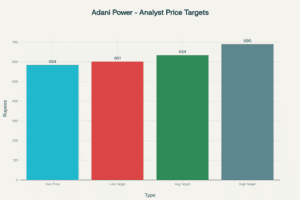

Adani Power analyst price targets showing potential upside from current levels

Impact Analysis

Benefits for Investors:

- Affordability: Lower share price for retail participation

- Liquidity: Enhanced trading volumes expected

- Psychological Impact: More accessible price point

- Market Expansion: Broader investor base

Financial Impact:

- No change in market capitalization

- No change in shareholding percentage

- No change in fundamental value

- Purely cosmetic adjustment to improve accessibility

Market Response और Expectations

Stock split announcement के बाद:

- Immediate Reaction: 2% price appreciation

- Retail Interest: Enhanced participation expected

- Volume Expansion: Trading activity increase anticipated

- Long-term Benefit: Better liquidity และ price discovery

Growth Prospects और Expansion Strategy

Capacity Expansion Roadmap

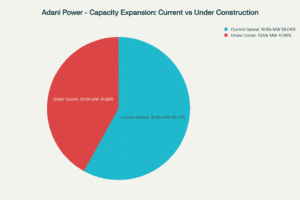

Adani Power capacity expansion showing significant growth pipeline with 13,120 MW under construction

Target Achievement by 2030:

- Current Capacity: 18,150 MW (operational)

- Under Construction: 13,120 MW (69% expansion)

- Target: 30,670 MW total capacity

- Investment: ~$13 billion planned capex

Recent Project Wins और Strategic Initiatives

Major Contract Wins (2024-25):

- Bihar Project: 2,400 MW, $3 billion investment

- UP Project: 1,500 MW at competitive ₹5.38/unit tariff

- Maharashtra: 6,600 MW composite project (thermal + solar)

- Vidarbha Acquisition: 600 MW plant for ₹4,000 crore

Technology Focus और Innovation

Ultra-supercritical Technology:

- Higher efficiency (>40% vs conventional 35%)

- Lower emissions per unit

- Advanced pollution control systems

- Future-ready для carbon trading opportunities

- Equipment pre-ordering for competitive advantage

Analyst Recommendations और Price Targets

Current Consensus

Strong Buy Rating:

- 3 Analysts: BUY recommendation

- 0 Analysts: HOLD

- 0 Analysts: SELL

- Average Target: ₹634 (10.94% upside)

- High Target: ₹690 (18.1% upside)

- Low Target: ₹601 (2.9% upside)

Growth Forecasts

Analyst Projections (Next 3 Years):

- Revenue Growth: 17.4% CAGR

- Earnings Growth: 13.4% CAGR

- EPS Growth: 13.2% CAGR

- Future ROE: 18.8%

Long-term Price Targets (Street Estimates)

2025-2030 Projections:

- 2025: ₹690

- 2026: ₹820

- 2027: ₹940

- 2028: ₹1,080

- 2030: ₹1,420

Disclaimer: These are speculative targets and actual performance may vary significantly.

Competitive Landscape

Major Competitors

Public Sector:

- NTPC Ltd: India’s largest power producer (80 GW capacity)

- NHPC: Hydroelectric power leader

- Power Grid Corporation: Transmission utility

Private Sector:

- Tata Power: Integrated utility (13+ GW capacity)

- JSW Energy: Diversified power producer

- Torrent Power: Regional utility player

Competitive Positioning

Adani Power’s Advantages:

- Scale Leadership: Largest private thermal producer

- Operational Excellence: 78% PLF vs industry 65%

- Geographic Diversification: Multi-state presence

- Long-term Contracts: 87% capacity tied up

- Financial Strength: Strong balance sheet

Competitive Challenges:

- NTPC: Lower cost of capital (government backing)

- Tata Power: Diversified portfolio (renewable + thermal)

- Renewable Competition: Solar/wind cost competitiveness

Adani Power: Risk Factors और Investment Concerns

Operational Risks

1. Coal Price Volatility:

- Heavy dependence on imported coal (Indonesia)

- Regulatory changes in exporting countries

- Currency fluctuation impact on fuel costs

- Coal transportation bottlenecks

2. Environmental Regulations:

- Stricter emission norms

- Carbon tax possibilities

- Coal ash disposal issues

- Water scarcity in some locations

3. Demand Risks:

- Economic slowdown impact

- Competition from renewables

- Industrial demand fluctuations

- Seasonal variations

Adani Power: Financial Risks

1. High Debt Levels:

- Planned 70% debt increase to $5.1 billion

- Interest rate sensitivity

- Refinancing risks

- Credit rating concerns

2. Regulatory Risks:

- Tariff revision delays

- Power purchase agreement disputes

- State government payment delays

- Policy changes on coal projects

3. Project Execution Risks:

- Construction delays

- Cost overruns

- Equipment delivery issues

- Environmental clearances

ESG और Sustainability Concerns

Carbon Footprint:

- 200+ million tonnes CO2 emissions annually expected

- Stranded asset risk estimated at $12 billion

- Transition to low-carbon future challenges

- International funding restrictions

Governance Issues:

- Adani Group controversy impact

- Credit rating agency concerns

- International investigation effects

- Market sentiment volatility

Recent Developments और News Updates

Bangladesh Recovery

Overdue Payments Resolution:

- Amount Recovered: $500+ million in Q1 FY26

- Regular Payments: Now receiving timely monthly payments

- Capacity: 1,496 MW supply to Bangladesh Power Development Board

- Contract: 25-year PPA signed in 2017

New Project Acquisitions

Vidarbha Industries Power:

- Acquisition Cost: ₹4,000 crore

- Capacity: 600 MW (2×300 MW)

- Location: Butibori, Nagpur, Maharashtra

- Process: NCLT approved resolution plan

- Impact: Takes total capacity to 18,150 MW

Adani Power: Equipment Contracts और Partnerships

L&T Partnership:

- Order Value: Ultra-mega category contract

- Capacity: 6,400 MW (8×800 MW units)

- Technology: Ultra-supercritical BTG packages

- Strategic: Equipment pre-ordering for competitive advantage

Investment Thesis और Strategy

Strengths

✅ Market Leadership: Largest private thermal power producer

✅ Operational Excellence: Industry-leading PLF of 78%

✅ Revenue Visibility: 87% capacity under long-term PPAs

✅ Growth Pipeline: 69% capacity expansion by 2030

✅ Technology Leadership: Ultra-supercritical plants

✅ Financial Recovery: Strong balance sheet improvement

✅ Stock Split Benefit: Enhanced retail accessibility

✅ Strategic Assets: Diversified geographic presence

Investment Concerns

⚠️ Environmental Headwinds: ESG और carbon transition pressure

⚠️ Coal Dependency: Volatile fuel costs और supply risks

⚠️ High Capex: $13 billion expansion requiring significant debt

⚠️ Regulatory Uncertainties: Policy changes और tariff revisions

⚠️ Competition: Renewable energy cost competitiveness

⚠️ Group Concerns: Adani Group controversy overhang

⚠️ Execution Risk: Large project portfolio management challenges

Investment Rating: BUY (Medium to Long-term)

Target Price Range: ₹650-700 (12-18 months)

Adani Power: Investment Strategy Recommendations

For Different Investor Types:

1. Growth Investors:

- Post Stock Split Entry: Take advantage of enhanced liquidity

- Capacity Expansion Play: Benefit from 69% growth pipeline

- Long-term Horizon: 3-5 years minimum holding period

- Expected Returns: 15-20% CAGR potential

2. Value Investors:

- Current Valuation: P/E 18.15 reasonable for power sector

- Asset Value: Book value ₹146 vs current price ₹584

- Wait Strategy: Consider entry on any correction below ₹550

3. Income Investors:

- Current Dividend: Zero dividend policy (growth reinvestment phase)

- Future Potential: Dividends expected post major capex completion

- Not Suitable: For immediate income requirements

4. Sector Play Investors:

- India Power Story: Growing electricity demand

- Baseload Requirement: Thermal power remains crucial

- Energy Security: Strategic importance maintained

Entry Strategy

Immediate Entry (Current Levels):

- Suitable for aggressive growth investors

- Take advantage of stock split liquidity benefits

- Dollar-cost averaging recommended

Staggered Entry (Recommended):

- First Tranche: 30% at current levels

- Second Tranche: 40% on any 10% correction

- Final Tranche: 30% on significant market weakness

Price Targets for Entry:

- Aggressive: ₹580-600 (current levels)

- Conservative: ₹520-550 (on correction)

- Deep Value: ₹450-500 (major market downturn)

Future Catalysts और Growth Drivers

Near-term Catalysts (6-12 months)

1. Stock Split Implementation: Enhanced liquidity और retail participation

2. New Project Commissioning: Capacity additions coming online

3. Power Demand Recovery: Post-monsoon industrial activity pickup

4. Contract Wins: New PPA announcements expected

Medium-term Drivers (1-3 years)

1. Capacity Ramp-up: 13,120 MW projects under construction

2. Merchant Tariff Recovery: Power prices normalization

3. Coal Linkage Improvement: Domestic coal access enhancement

4. Technology Premium: Ultra-supercritical plant advantages

Long-term Themes (3-5 years)

1. Power Demand Growth: India’s industrialization और urbanization

2. Baseload Requirement: Thermal power remains essential

3. Energy Security: Strategic importance in national grid

4. Carbon Trading: Future revenue stream potential

निष्कर्ष और Final Recommendation

Adani Power Limited India की thermal power sector में एक dominant player है जो country के energy security में vital role निभा रही है। Company का 18,150 MW current capacity और 30,670 MW by 2030 target इसकी ambitious growth plans को दर्शाता है।

Key Investment Highlights:

Positive Factors:

- Market Leadership और operational excellence

- Strong revenue visibility (87% long-term contracts)

- Historic Stock Split enhancing accessibility

- Massive Growth Pipeline (69% capacity expansion)

- Technology Leadership in ultra-supercritical plants

- Geographic Diversification across multiple states

Risk Considerations:

- Environmental concerns और ESG pressure

- High debt expansion plans requiring $2.1 billion

- Coal price volatility और supply chain risks

- Execution challenges with large project portfolio

- Regulatory uncertainties और policy changes

Final Investment Verdict: BUY (Long-term)

Recommended Investment Strategy:

- Primary Allocation: 3-5% of equity portfolio

- Investment Horizon: Minimum 3-5 years

- Entry Method: Staggered investment approach

- Target Returns: 15-20% CAGR over long term

Post Stock Split Opportunity:

Stock split के बाद enhanced liquidity और better price discovery expected है। यह retail investors के लिए एक golden opportunity है affordable price point पर India’s power story में participate करने का।

Risk Management:

- Monitor quarterly results closely

- Track project commissioning progress

- Stay updated on regulatory changes

- Watch coal price trends और environmental policies

Adani Power India की growing energy needs और industrial development के साथ grow करने का potential रखती है। Despite challenges, company की strategic position, operational excellence, और expansion plans इसे long-term wealth creation के लिए एक attractive investment बनाते हैं।

Disclaimer: यह analysis educational purpose के लिए है। Investment decisions से पहले professional financial advice लें और अपनी risk appetite consider करें।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

- Also Read :

- NTPC Green Energy में निवेश करें या नहीं? क्या यह अगला मल्टीबैगर है?2025

- ONGC का भविष्य: 2025 में ग्रोथ, चैलेंज और अपॉर्च्युनिटी का एनालिसिस

- Easy My Trip शेयर की पूरी जानकारी 2025 | Travel Stock Guide

- HCL Infosystems शेयर में निवेश करना चाहिए या नहीं 2025 ||