Adani Group Latest 2025 | भारत की अग्रणी इंफ्रास्ट्रक्चर कंपनी || Invest Kare Ya Nahi?? पूरी जानकारी ||

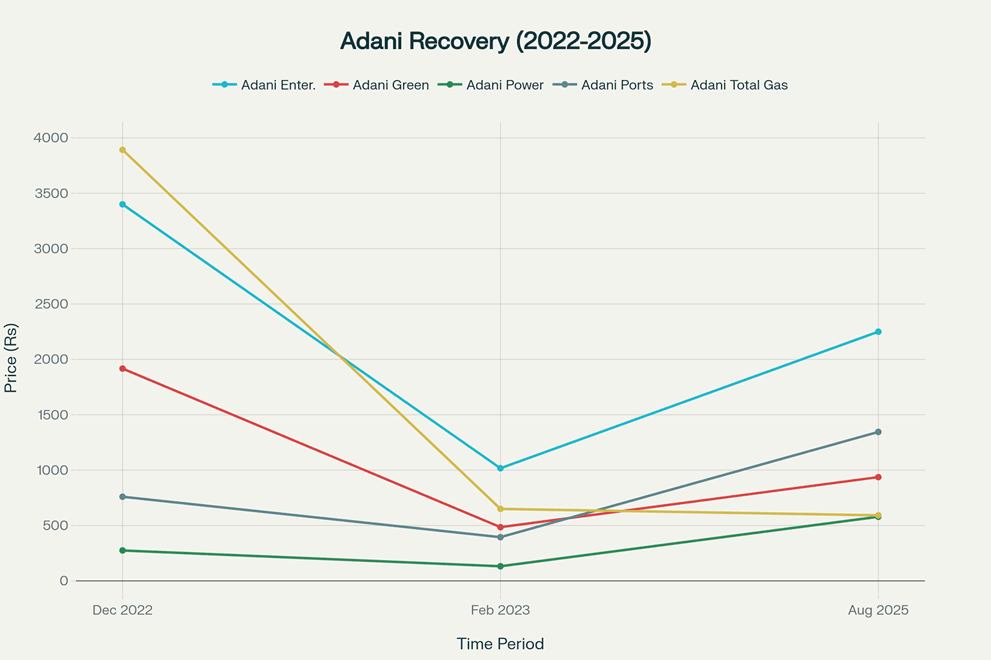

Adani Group गौतम अदाणी के नेतृत्व में भारत का सबसे बड़ा infrastructure conglomerate है जो ports से लेकर renewable energy तक विविध sectors में अपनी मजबूत उपस्थिति रखता है। अगस्त 7, 2025 तक Group की सभी listed companies का total market capitalization लगभग Rs 13 लाख करोड़ है। Despite facing significant challenges from Hindenburg Research reports in 2023-24, Adani Group ने remarkable recovery दिखाई है और FY25 में अपना highest-ever EBITDA of Rs 89,806 करोड़ achieve किया है। Group का flagship company Adani Enterprises Rs 2,249.80 पर trade कर रहा है, जबकि Adani Ports Rs 1,345.40, Adani Green Energy Rs 936.70, और Adani Power Rs 578.95 पर है।

Adani Group का Portfolio Overview

Major Listed Companies और Current Market Position

Adani Group stocks show strong recovery from Hindenburg impact, with most companies regaining significant value by August 2025

Key Companies Performance (August 7, 2025):

1. Adani Enterprises (ADANIENT):

- Share Price: Rs 2,249.80 (NSE), -2.20% daily change

- Market Cap: Rs 2,59,656 करोड़

- 52-Week Range: Rs 2,025 – Rs 3,243

- Business Focus: Mining, resources, airports, data centers, solar manufacturing

- FY25 Performance: Revenue Rs 97,895 करोड़, EBITDA Rs 17,316 करोड़

2. Adani Ports & Special Economic Zone (ADANIPORTS):

- Share Price: Rs 1,345.40 (NSE), -1.59% daily change

- Market Cap: Rs 2,90,721 करोड़

- 52-Week Range: Rs 994 – Rs 1,556

- Business Focus: Port development, logistics, special economic zones

- FY25 Performance: Revenue Rs 30,475 करोड़, EBITDA Rs 20,471 करोड़

3. Adani Green Energy (ADANIGREEN):

- Share Price: Rs 936.70 (NSE), -2.18% daily change

- Market Cap: Rs 1,55,371 करोड़

- 52-Week Range: Rs 758 – Rs 2,092

- Business Focus: Solar and wind power generation, renewable energy parks

- FY25 Performance: Revenue Rs 11,212 करोड़, EBITDA Rs 10,532 करोड़

4. Adani Power (ADANIPOWER):

- Share Price: Rs 578.95 (NSE), +2.03% daily change

- Market Cap: Rs 2,23,514 करोड़

- 52-Week Range: Rs 431 – Rs 707

- Business Focus: Thermal power generation, largest private power producer

- FY25 Performance: Revenue Rs 56,203 करोड़, EBITDA Rs 23,917 करोड़

5. Adani Total Gas (ATGL):

- Share Price: Rs 591.85 (NSE), +0.48% daily change

- Market Cap: Rs 65,070 करोड़

- 52-Week Range: Rs 468 – Rs 912

- Business Focus: City gas distribution, CNG, PNG, EV charging

- FY25 Performance: Revenue Rs 4,813 करोड़, EBITDA Rs 1,179 करोड़

A large container ship docked at an Adani Group port terminal in India, highlighting their extensive shipping and logistics operations.

FY25 Financial Performance: Record-Breaking Results

Adani Group Consolidated Performance

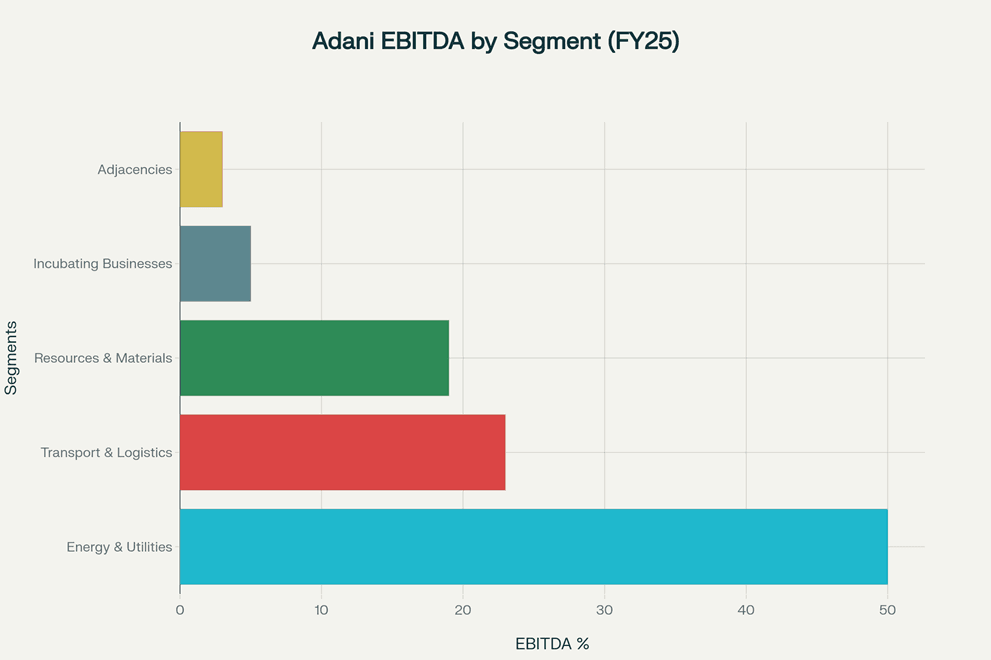

Energy & Utilities dominate Adani Group’s EBITDA at 50%, followed by Transport & Logistics and Resources

Stellar FY25 Highlights:

- Total Revenue: Rs 2,71,664 करोड़ (+7% YoY growth)

- Portfolio EBITDA: Rs 89,806 करोड़ (highest ever, +8.2% YoY)

- Net Profit: Rs 40,565 करोड़ (+16% YoY)

- Gross Assets: Rs 6,09,133 करोड़ (+25.6% YoY)

- Return on Assets (ROA): 16.5% (among highest globally in infrastructure)

Strong Financial Position:

- Cash Balance: Rs 53,843 करोड़ (18.5% of gross debt)

- Liquidity Cover: 21 months of debt servicing obligations

- Net Debt-to-EBITDA: Improved to 2.6x from 3.8x in FY19

- Gross Debt: Rs 2.9 lakh करोड़ (up from Rs 2.41 lakh करोड़ in FY24)

Adani Group Company-wise Performance Analysis

Energy & Utilities Segment (50% of Portfolio EBITDA):

Adani Power – Thermal Power Leadership:

- Units Sold: 95.9 billion units in FY25 (vs 79.4 BU in FY24)

- Plant Load Factor: 70.5% (vs 64.7% in FY24)

- Installed Capacity: 17.5 GW (targeting 31 GW by 2030)

- Recent Win: Rs 18,000 करोड़ Bihar 2,400 MW thermal project at Rs 6.075/unit

Adani Green Energy – Renewable Pioneer:

- Operational Capacity: 10.9 GW renewable energy

- World’s Largest: Khavda renewable energy park in Gujarat (visible from space)

- Target 2030: 50 GW renewable capacity

- Investment: Major capex for solar and wind projects

Adani Total Gas – Energy Transition Leader:

- Network: 605 CNG stations operational

- PNG Connections: 9.22 lakh household connections

- EV Charging: 1,914 charging points across 226 cities

- Volume Growth: 15% YoY increase in sales volume

Transport & Logistics Segment (23% of Portfolio EBITDA):

Adani Ports – India’s Port Giant:

- Capacity: 450 MTPA current port handling capacity

- Market Share: ~25% of India’s port traffic

- Q1 FY26: Net profit Rs 3,315 करोड़ (+7% YoY), beats estimates

- Expansion: Targeting 800 MTPA capacity by 2030

Adani Group’s hybrid renewable energy installation with solar panels and wind turbines in a green field.

Adani Group Business Diversification Strategy और Growth Plans

Core Business Segments

1. Energy & Utilities (50% EBITDA Contribution):

- Thermal Power: 17.5 GW capacity, targeting 31 GW by 2030

- Renewable Energy: 10.9 GW operational, targeting 50 GW by 2030

- Transmission: Adani Energy Solutions with significant grid presence

- Gas Distribution: 34 geographical areas, targeting 50 GAs

2. Transport & Logistics (23% EBITDA Contribution):

- Ports: India’s largest private port operator with 450 MTPA capacity

- Logistics: Integrated supply chain and cargo handling

- Airports: Ahmedabad, Lucknow, Mangalore, Thiruvananthapuram airports

- Railways: Rail infrastructure and transportation projects

3. Resources & Materials (19% EBITDA Contribution):

- Mining: Coal, copper, iron ore mining operations

- Metals & Minerals Trading: Commodity trading and processing

- Industrial Materials: Raw material supplies for infrastructure

4. Incubating Businesses (5% EBITDA Contribution):

- Digital Infrastructure: Data centers and digital services

- Aerospace & Defence: Defence manufacturing and services

- Agri Business: Food processing and agricultural value chain

5. Adjacencies (3% EBITDA Contribution):

- Cement: ACC and Ambuja Cement with 70 MTPA capacity

- Petrochemicals: Chemical processing and manufacturing

- Real Estate: Industrial and commercial real estate development

Capacity Expansion Roadmap

Massive Capex Plan ($15-20 Billion Annually):

Gautam Adani announced record-breaking investment plan of $15-20 billion annually for next five years।[5]

Key Expansion Targets by 2030:

- Power Generation: 31 GW thermal + 50 GW renewable = 81 GW total

- Port Capacity: 800 MTPA (current 450 MTPA)

- Gas Distribution: 50 geographical areas (current 34 GAs)

- Cement Capacity: 140 MTPA (current 70 MTPA)

- Airport Operations: Additional airports through privatization program

Investment Allocation:

- Renewable Energy: Rs 75,000 करोड़ for 50 GW capacity

- Thermal Power: Rs 45,000 करोड़ for capacity expansion

- Port Infrastructure: Rs 35,000 करोड़ for 800 MTPA target

- Cement Business: Rs 25,000 करोड़ for capacity doubling

- Gas Distribution: Rs 15,000 करोड़ for network expansion

Hindenburg Research Impact: Recovery और Resilience

Timeline of Events और Market Impact

January 2023 – First Hindenburg Report:

- Allegations: “Largest con in corporate history,” accounting fraud, stock manipulation

- Market Impact: $150 billion market value wiped off

- Stock Decline: 50-83% fall across group companies

- Major Fallout: Rs 20,000 करोड़ FPO cancelled

February 2023 – Peak Impact:

- Market Cap Loss: From Rs 19 lakh करोड़ to Rs 9 lakh करोड़

- Investor Wealth: Rs 7 lakh करोड़ erased

- Stock Prices: All companies hit multi-month lows

August 2024 – Second Hindenburg Report:

- Target: SEBI chief Madhabi Puri Buch and her husband

- Allegations: Conflict of interest in Adani investigation

- Market Reaction: Only $2.43 billion loss (vs $150 billion in first report)

- Recovery Sign: Market showed resilience to second attack

August 2025 – Current Status:

- Full Recovery: Most stocks recovered to pre-Hindenburg levels or higher

- Business Operations: Normal operations with strong financial performance

- Market Confidence: Institutions and investors regained confidence

Adani Group’s Response और Corrective Actions

Immediate Actions Taken:

- Debt Reduction: Net debt-to-EBITDA improved from 3.8x to 2.6x

- Cash Building: Maintained Rs 53,843 करोड़ cash balance

- Governance Enhancement: Strengthened corporate governance practices

- Transparency: Regular disclosure and investor communications

Long-term Reforms:

- ESG Initiatives: Enhanced ESG scores and ratings

- Tax Transparency: Released tax transparency reports

- Independent Directors: Strengthened board composition

- Risk Management: Improved risk assessment and management systems

January 2025 – Vindication:

- Hindenburg Shutdown: US short seller announced closure of operations

- Stock Rally: Adani stocks surged 3-9% on Hindenburg shutdown news

- Market Relief: Investor sentiment significantly improved

Profile of Gautam Adani, founder of the Adani Group, outlining his business background and controversies.

Recent Developments और Strategic Initiatives

Major Business Wins और Project Updates

Adani Power Expansion:

- Bihar Project: Won 2,400 MW (3×800 MW) thermal power project from BSPGCL

- Tariff: Competitive rate of Rs 6.075/unit for long-term PPA

- Investment: ~$3 billion (Rs 24,000+ करोड़) project investment

- Technology: Ultra-supercritical technology for environment-friendly operations

- Timeline: First unit in 48 months, complete project in 60 months

Stock Split Announcement:

- Adani Power: Announced 1:5 stock split (Rs 10 to Rs 2 face value)

- Shareholder Benefit: Improved affordability and liquidity for retail investors

Adani Green Energy Progress:

- Khavda Project: World’s largest renewable energy park development

- Capacity Addition: Continuous expansion of solar and wind projects

- Technology Integration: Advanced grid-scale battery storage systems

Adani Total Gas Growth:

- APM Gas Allocation: Increased from 37% to 51% for CNG operations

- Infrastructure: Expanding CNG stations and PNG network

- EV Charging: Rapid deployment across 226 cities

- Biogas Initiative: Compressed biogas plant development

International Expansion और Partnerships

Global Presence:

- Port Operations: International port management contracts

- Energy Projects: Renewable energy projects in emerging markets

- Mining Operations: Global coal and mineral resources development

- Technology Partnerships: Collaborations with international technology providers

Investment Analysis: Valuation और Risk-Reward Assessment

Current Valuation Metrics

Key Financial Ratios:

- Adani Enterprises: P/E 72.5, P/B 5.16, ROE 9.82%

- Adani Ports: P/E 25.6, P/B 4.74, ROE 18.7%

- Adani Green: P/E 82.6, P/B 12.2, ROE 14.6%

- Adani Power: P/E 18.4, P/B 3.97, ROE 25.7%

- Adani Total Gas: P/E 35.8, P/B 15.5, ROE 18.2%

Portfolio-wide Strengths:

- High ROA: 16.5% among highest globally in infrastructure

- Strong Cash Position: Rs 53,843 करोड़ providing 21 months coverage

- Deleveraging: Net debt-to-EBITDA improving consistently

- Growth Visibility: Clear expansion plans with committed capex

Investment Drivers

Positive Catalysts:

1. India’s Infrastructure Growth Story:

- Government Support: National Infrastructure Pipeline worth Rs 111 lakh करोड़

- Renewable Target: India’s 500 GW renewable energy target by 2030

- Port Modernization: Sagarmala project boosting port development

- Energy Transition: Coal to renewable energy shift benefiting Adani

2. Market Leadership Positions:

- Port Traffic: ~25% market share in Indian ports

- Private Power: Largest private thermal power generator

- Renewable Energy: Leadership in solar and wind development

- City Gas: Significant presence in expanding CGD market

3. Diversified Business Model:

- Multiple Revenue Streams: Reduces single-sector dependence

- Defensive Characteristics: Essential infrastructure services

- Cross-selling Opportunities: Integrated value chain benefits

- Economic Moats: High entry barriers in infrastructure

4. ESG और Sustainability Focus:

- Carbon Neutrality: 2050 net-zero commitment

- Renewable Investment: Rs 75,000 करोड़ for clean energy

- ESG Ratings: Improved scores from international agencies

- Community Development: Rs 1,000 करोड़ CSR commitment

Risk Factors

Key Investment Risks:

1. High Leverage और Debt Concerns:

- Gross Debt: Rs 2.9 lakh करोड़ requires careful management

- Interest Burden: High finance costs impacting profitability

- Refinancing Risk: Regular debt refinancing requirements

- Rating Dependency: Credit rating changes affecting borrowing costs

2. Regulatory और Policy Risks:

- Environmental Approvals: Project delays due to regulatory issues

- Policy Changes: Government policy shifts affecting business

- Tariff Regulations: Power tariff determination by state regulators

- Land Acquisition: Challenges in large project development

3. Execution Risks:

- Project Delays: Large infrastructure projects timeline risks

- Cost Overruns: Construction and commodity price inflation

- Technology Risks: Renewable energy technology evolution

- Operational Challenges: Managing diverse business portfolio

4. Market और Competition Risks:

- Economic Slowdown: Impact on demand for infrastructure services

- Competition Intensification: New players in renewable energy

- Commodity Price Volatility: Impact on mining and trading businesses

- Interest Rate Changes: Affecting project viability and costs

ESG Initiatives और Sustainability Roadmap

Environmental Commitments

Carbon Neutrality Target:

- 2050 Net Zero: Comprehensive carbon neutrality commitment

- Scope 1 & 2: Direct and indirect emission reduction plans

- Scope 3: Value chain emission management

- Investment: Rs 1,00,000 करोड़ for carbon neutrality initiatives

Renewable Energy Expansion:

- 50 GW by 2030: Ambitious renewable capacity target

- Technology Mix: Solar, wind, hybrid, and storage integration

- Grid Integration: Advanced grid management and storage systems

- Green Hydrogen: Future focus on hydrogen production

Water और Waste Management:

- Water Positive: 40% reduction in water consumption achieved

- Zero Liquid Discharge: Implementation across manufacturing units

- Waste Management: Circular economy principles adoption

- Biodiversity: Conservation programs around project sites

Social Impact Initiatives

Community Development:

- CSR Investment: Rs 750 करोड़ spent in FY25, targeting Rs 1,000 करोड़

- Education: Skill development and educational programs

- Healthcare: Medical facilities और health awareness programs

- Livelihood: Rural livelihood generation initiatives

Employment Generation:

- Direct Employment: 50,000+ direct jobs across group companies

- Indirect Employment: 5 lakh+ indirect jobs through value chain

- Skill Development: Training programs for local communities

- Women Empowerment: Gender diversity और empowerment programs

Governance Excellence

Board Structure:

- Independent Directors: Strengthened independent board composition

- Committee Structure: Robust audit, risk, and nomination committees

- Diversity: Gender और skill diversity in leadership

- Succession Planning: Clear leadership succession frameworks

Transparency and Disclosure:

- Regular Reporting: Quarterly investor calls and presentations

- ESG Reporting: Comprehensive sustainability reports

- Tax Transparency: Detailed tax strategy और payment disclosures

- Stakeholder Engagement: Regular communication with all stakeholders

Future Outlook और Strategic Vision

Vision 2030: Transformation Roadmap

Business Portfolio Evolution:

- Energy Transition Leader: 50 GW renewable + 31 GW efficient thermal

- Digital Infrastructure: Data centers और digital services expansion

- Sustainable Materials: Green cement और sustainable construction

- Global Expansion: International project development

Technology Integration:

- Digitalization: AI और IoT across operations

- Automation: Robotics और process automation

- Smart Grid: Advanced grid management systems

- Green Technologies: Clean energy और carbon capture technologies

Financial Targets और Projections

Revenue Growth:

- FY26-30 CAGR: 15-20% sustainable revenue growth

- EBITDA Expansion: Targeting Rs 1,50,000+ करोड़ by FY30

- ROA Maintenance: Sustaining 15%+ return on assets

- Debt Management: Net debt-to-EBITDA below 3.0x

Capacity Expansion Milestones:

- Power Generation: 81 GW total capacity (thermal + renewable)

- Port Handling: 800 MTPA capacity for 40%+ market share

- Gas Distribution: 50 geographical areas serving 50+ cities

- Cement Production: 140 MTPA capacity for market leadership

Investment Recommendation और Strategy

Overall Investment Thesis

Strong Buy Recommendation – Target: 20-25% returns over 3-5 years

Core Investment Rationale:

1. Infrastructure Megatrend:

- India’s $5 trillion economy target requires massive infrastructure investment

- Government’s National Infrastructure Pipeline creating opportunities

- Demographic dividend driving consumption और infrastructure demand

- Adani positioned as key beneficiary of this growth story

2. Market Leadership across Segments:

- Dominant positions in ports, power, और renewable energy

- High entry barriers और economic moats in infrastructure

- Integrated business model providing competitive advantages

- Brand recognition और execution track record

3. Energy Transition Opportunity:

- Early mover advantage in renewable energy space

- Comprehensive clean energy strategy from generation to distribution

- Government support for renewable energy development

- Global trend towards sustainable energy benefiting Adani Green

4. Financial Strength और Recovery:

- Complete recovery from Hindenburg impact demonstrating resilience

- Strong balance sheet with improving debt metrics

- Consistent cash generation और investment capability

- Management credibility restored through performance delivery

Portfolio Approach Investment Strategy

Diversified Adani Group Investment:

Core Holdings (60% allocation):

- Adani Ports (30%): Stable defensive play with dividend yield

- Adani Power (30%): Value pick with strong operational metrics

Growth Holdings (30% allocation):

- Adani Green Energy (20%): Long-term renewable energy growth

- Adani Enterprises (10%): Diversified holding company exposure

Satellite Holdings (10% allocation):

- Adani Total Gas (5%): Energy transition play

- Adani Energy Solutions (5%): Transmission infrastructure

Risk Management Strategy

Position Sizing:

- Maximum Exposure: 8-12% of total equity portfolio

- Individual Stock Limit: No single Adani stock >3% of portfolio

- Diversification: Spread across different group companies

- Monitoring: Regular review of debt levels और project execution

Entry और Exit Strategy:

- Phased Entry: Dollar-cost averaging over 6-12 months

- Price Triggers: Accumulate on 10-15% corrections

- Profit Booking: Partial booking at 30%+ gains

- Stop Loss: Group exposure below Rs 10 lakh करोड़ market cap

Key Monitoring Parameters

Financial Metrics:

- Net debt-to-EBITDA ratios across companies

- EBITDA growth और margin trends

- Cash flow generation और capex execution

- Interest coverage ratios

Operational KPIs:

- Power generation Plant Load Factors

- Port traffic growth rates

- Renewable energy capacity additions

- Gas distribution network expansion

External Factors:

- Government policy changes

- Regulatory developments

- Environmental clearances

- Credit rating actions

निष्कर्ष

Adani Group भारत का सबसे dynamic और growth-oriented infrastructure conglomerate है जो successfully Hindenburg crisis से recover होकर अपनी strength demonstrate कर चुका है। FY25 में record EBITDA of Rs 89,806 करोड़ और 16.5% ROA के साथ, Group ने अपनी operational excellence और financial discipline साबित की है।

Investment Highlights:

Transformation Success:

- Complete Recovery: Hindenburg impact से पूर्ण recovery

- Record Performance: All-time high EBITDA और profitability

- Strong Balance Sheet: Rs 53,843 करोड़ cash balance

- Deleveraging: Net debt-to-EBITDA में सुधार

Growth Potential:

- Infrastructure Megatrend: India के $5 trillion economy vision के beneficiary

- Energy Transition: 50 GW renewable target by 2030

- Market Leadership: Multiple sectors में dominant positions

- Capacity Expansion: $15-20 billion annual investment plan

ESG Leadership:

- Carbon Neutrality: 2050 net-zero commitment

- Sustainability: Rs 1,00,000 करोड़ ESG investment

- Community Impact: Rs 1,000 करोड़ CSR initiatives

- Governance: Enhanced transparency और best practices

Investment Opportunity:

यह एक multi-decade growth story है जो India के infrastructure development और energy transition में key role play करने वाली है। Current valuations पर, diversified Adani portfolio approach से 20-25% CAGR returns potential है।

Final Assessment:

Adani Group stocks represent a compelling long-term investment opportunity for investors willing to bet on India’s infrastructure growth story। Proper risk management और diversified approach के साथ, यह portfolio का significant value creator बन सकता है।

Investment Rating: ⭐⭐⭐⭐ (4.5/5)

Risk Level: Medium-High

Investment Horizon: 3-5 years minimum

Expected Returns: 20-25% CAGR potential

Key Message: “Adani Group – India की Infrastructure Growth Story का Heart, Energy Transition का Leader”

यह investment उन लोगों के लिए ideal है जो India के long-term growth potential में believe करते हैं और patience के साथ wealth creation चाहते हैं।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”