Adani Energy Solutions Ltd Share Analysis 2025 | Complete Investment Guide Hindi |

Adani Energy Solutions Limited (AESL) भारत की सबसे बड़ी private sector transmission और distribution company है जो 26,696 circuit km का transmission network और 93,200 MVA transformation capacity के साथ देश के energy infrastructure को मजबूत बना रही है। यह कंपनी Adani Group की flagship energy utilities arm है और smart metering, transmission, और distribution के क्षेत्र में अग्रणी है।

Adani Energy: कंपनी का परिचय और Business Model

Historical Background

Adani Energy Solutions की शुरुआत 2006 में Adani Group के power transmission sector में entry के साथ हुई, जब company ने Mundra thermal power plant से power evacuation के लिए dedicated transmission lines develop किए। 2015 में company को separately list किया गया और तब से यह India के transmission sector में consistently grow कर रही है।

Core Business Segments

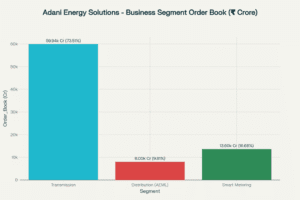

Adani Energy Solutions business segment order book breakdown showing Transmission as the dominant segment

1. Power Transmission (73% of Order Book – ₹59,936 crore)

- 26,696 circuit km transmission network across 14 states

- 93,200 MVA transformation capacity

- 99.7% network availability (industry leading)

- High voltage AC lines: 132kV, 220kV, 400kV, 765kV

- HVDC transmission lines: +/-500kV

2. Power Distribution

- Adani Electricity Mumbai Ltd (AEML): 3.18 million consumers

- Mumbai’s largest private distribution utility

- 99.9% supply reliability consistently maintained

- 4.31% distribution losses (among lowest in country)

- Integrated model covering generation, transmission और distribution

3. Smart Metering (₹13,600 crore pipeline)

- 22.8 million smart meters under construction pipeline

- Presence across 5 states

- Current installation rate: 15,000 meters per day

- Target: 20,000 meters per day

- Major contracts: BEST, MESDCL, APDCL

Recent Expansion और New Projects

Major Project Wins (2024-25):

- Bhadla-Fatehpur HVDC Project: ₹25,000 crore (largest single project)

- Khavda Phase IV Part-D: ₹3,455 crore

- Maharashtra Inter-State Project: ₹1,600 crore

- Gujarat Green Hydrogen Project: ₹2,800 crore

Management Team और Leadership

CEO: Kandarp Patel – Vision और Experience

Professional Journey:

- Chief Executive Officer since November 2022

- 20+ years experience in power sector

- Started career with Gujarat Electricity Board (GEB) as Controller

- Adani Group association since 2004

- Led Power Trading business at Adani Enterprises

- Successfully executed 10,000+ MW PPAs for Adani Power

Key Achievements:

- “Most Innovative Young Power Professional” award by IPPAI (2017)

- Successfully led Lanco integration (2013)

- International training programs in Washington DC and Singapore

Educational Background:

- B.E. Electrical Engineering – Birla Vishvakarma Mahavidyalaya (1994)

- MBA Finance – G.H. Patel PG Institute (1997)

Board of Directors

Managing Director: Anil Sardana (MD – Thermal Power भी)

CFO: Kunjal Mehta

Company Secretary: Key managerial personnel with extensive experience

Financial Performance और Recovery Analysis

Q1 FY26: Spectacular Turnaround

Outstanding Performance Highlights:

- Total Income: ₹7,025.49 crore (28% YoY growth)

- Net Profit: ₹538.94 crore (complete turnaround from ₹-1,191 crore loss)

- EBITDA: ₹2,017 crore (14.5% YoY growth)

- EPS: ₹4.30 (vs ₹-9.91 in Q1 FY25)

- Cash Profit: ₹1,043 crore (15% YoY growth)

Multi-year Financial Trend

Revenue Growth Trajectory:

- FY25: ₹24,447 crore (42% growth)

- FY24: ₹17,218 crore (3.9% growth)

- FY23: ₹16,524 crore

- 3-year Revenue CAGR: 21.8%

Profitability Recovery:

- FY25: ₹2,427 crore PAT (103% growth)

- FY24: ₹1,195 crore PAT (16.8% growth)

- FY23: ₹1,023 crore PAT

Operational Excellence Metrics

Transmission Business:

- Network Availability: 99.7% (industry benchmark 98%)

- Average Residual Life: 33 years

- Project Commissioning: 3 new projects in Q1 FY26

Distribution Business (AEML):

- Supply Reliability: >99.9%

- Distribution Losses: 4.31% (among India’s lowest)

- E-payment Adoption: 83.2% of collections

- Renewable Energy Share: 36% (target 60% by FY27)

Key Financial Metrics और Valuation

Current Market Position

- Current Price: ₹775.80 (August 2025)

- Market Cap: ₹93,195 crore

- 52-Week Range: ₹588 – ₹1,138

- P/E Ratio: 38.86

- P/B Ratio: 4.22

- Book Value: ₹183.71

- ROE: 10.74%

- Debt-to-Equity: 1.83

Balance Sheet Strength

Liquidity Position:

- Cash Balance: ₹60.6 billion

- No major debt maturities in next 12 months

- Only $500 million bond maturing August 2026

- Net Leverage: Expected 5.4x (FY25-27)

- EBITDA Interest Coverage: 2.3x

Growth Prospects और Future Outlook

Analyst Projections

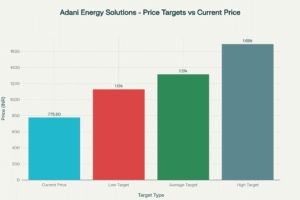

Analyst price targets for Adani Energy Solutions showing upside potential from current price

Consensus Forecasts:

- Revenue CAGR: 13.2% (next 3 years)

- Earnings CAGR: 15.2% (next 3 years)

- EPS CAGR: 12.4% (next 3 years)

- Future ROE: 11% (3-year forecast)

Analyst Price Targets

Strong Buy Consensus:

- Average Target: ₹1,314.25 (59.4% upside)

- High Target: ₹1,690 (117.9% upside)

- Low Target: ₹1,127 (45.3% upside)

- Analyst Recommendation: Strong Buy (4 Buy, 0 Hold, 0 Sell)

Strategic Growth Drivers

1. Transmission Expansion:

- Target: 30,000 ckm by 2030

- Current pipeline: ₹59,936 crore

- Focus on renewable energy evacuation

- HVDC technology leadership

2. Smart Metering Revolution:

- 101 million meters untapped market opportunity

- Current pipeline: 22.8 million meters

- Expected to contribute 25%+ EBITDA by FY26

- Fast cash conversion cycle

3. Distribution Efficiency:

- Mumbai utility modernization

- Integration of renewable energy sources

- Digital payment platform expansion

4. Capital Expenditure Plans:

- FY25-26: ₹175 billion annually expected

- Focus on transmission infrastructure

- Smart grid technologies adoption

- Renewable energy integration projects

Competitive Landscape

Major Competitors

Transmission Sector:

- Power Grid Corporation of India (PSU leader)

- NTPC (integrated power company)

- Sterlite Power (private transmission)

- KEC International (EPC contractor)

Competitive Advantages

1. Market Leadership: India’s largest private transmission company

2. Geographic Spread: Presence across 14 states

3. Technology Excellence: 99.7% availability vs industry 98%

4. Project Execution: Proven track record in complex projects

5. Financial Strength: Strong balance sheet और cash position

6. Integrated Model: End-to-end energy solutions

Market Share Analysis

Transmission Sector:

- 24% market share in TBCB (Tariff Based Competitive Bidding)

- Largest order book among private players

- Leadership in HVDC technology

Recent Developments और Strategic Initiatives

Major Project Wins (2024-25)

Record Order Book Growth:

- Total Pipeline: ₹81,536 crore

- Q3 FY25: Won projects worth ₹28,455 crore

- Largest HVDC Project: Bhadla-Fatehpur (₹25,000 crore)

- Renewable Integration: Multiple green energy projects

Operational Achievements

Smart Metering Progress:

- Daily Installation Rate: 15,000 meters/day

- Cumulative Installation: 55.4 lakh smart meters

- Target Enhancement: 20,000 meters/day

- State Coverage: Maharashtra, Gujarat, Assam, Andhra Pradesh, Mumbai

ESG और Sustainability Initiatives

Environmental Commitments:

- Net Zero Target: 2050

- Renewable Energy: 36% in AEML (target 60% by FY27)

- UNEZA Membership: First Indian power company

- Global Recognition: Sustainability awards 2023

Risk Factors और Challenges

Regulatory और Legal Risks

US Investigation Impact:

- Fitch Rating: Negative outlook assigned

- Governance Concerns: Potential impact on funding access

- Investigation Outcome: Could affect credit ratings

- Market Sentiment: Negative impact on stock performance

Operational Risks

1. Execution Risk: Large order book execution challenges

2. Regulatory Changes: Power sector policy modifications

3. Counter-party Risk: State DISCOMs financial health (smart metering)

4. Technology Risk: Evolving grid technologies

5. Environmental Clearances: Project approval delays

Financial Risks

1. High Debt Levels: Debt-to-equity ratio 1.83

2. Capital Intensive: High capex requirements

3. Interest Rate Sensitivity: Rising rates impact

4. Currency Risk: International funding exposure

5. Working Capital: Extended payment cycles

Market Risks

1. Power Demand Fluctuations: Economic slowdown impact

2. Competitive Pressure: New entrants in transmission

3. Valuation Concerns: High P/E ratio 38.86

4. Policy Changes: Renewable energy policies

5. Grid Stability: Technical challenges in integration

Investment Thesis और Strategic Analysis

Strengths

✅ Market Leadership: India’s largest private T&D company

✅ Strong Order Book: ₹81,536 crore pipeline

✅ Operational Excellence: 99.7% network availability

✅ Diversified Portfolio: Transmission, distribution, smart metering

✅ Financial Recovery: Strong turnaround in Q1 FY26

✅ Growth Visibility: Clear expansion roadmap till 2030

✅ Technology Leadership: HVDC और smart grid expertise

✅ Strategic Assets: Mumbai distribution utility

Concerns और Challenges

⚠️ Regulatory Overhang: US investigation impact

⚠️ High Valuations: P/E 38.86 vs sector average

⚠️ Debt Levels: D/E ratio 1.83

⚠️ Execution Risk: Large project portfolio management

⚠️ Policy Dependency: Government power sector policies

⚠️ Counter-party Risk: DISCOM financial health

⚠️ Stock Volatility: High beta और price swings

Investment Rating: BUY (Long-term)

Target Price Range: ₹1,200-1,400 (12-18 months)

Investment Strategy Recommendations

For Different Investor Profiles:

1. Growth Investors:

- Current Entry: Suitable for aggressive investors

- SIP Strategy: Recommended for risk management

- Hold Period: 3-5 years minimum

- Target Returns: 15-20% CAGR potential

2. Value Investors:

- Wait Strategy: Current valuations stretched

- Entry Levels: ₹650-700 on corrections

- Focus Areas: Asset quality और order book execution

3. Income Investors:

- Dividend Yield: Currently 0% (not suitable)

- Capital Appreciation: Primary return driver

- Bond Alternative: Consider for interest rate hedge

4. Long-term Investors:

- Sector Play: India’s power infrastructure growth

- Renewable Transition: Beneficiary of energy transition

- Infrastructure Boom: Government capex boost

Future Catalysts और Growth Triggers

Near-term Catalysts (6-12 months)

1. Project Commissioning: Multiple transmission lines commissioning

2. Smart Meter Ramp-up: Maharashtra circle acceleration

3. Order Book Wins: New TBCB project announcements

4. Financial Performance: Consistent quarterly improvements

Medium-term Drivers (1-3 years)

1. Capacity Expansion: 30,000 ckm target progress

2. Renewable Integration: Green energy corridor development

3. Smart Grid Revolution: Advanced metering infrastructure

4. Distribution Efficiency: Mumbai utility modernization

Long-term Themes (3-5 years)

1. Energy Transition: Renewable capacity addition support

2. Grid Modernization: Digital infrastructure upgrade

3. Electric Vehicle: Charging infrastructure support

4. Energy Security: Strategic importance increase

निष्कर्ष और Final Recommendation

Adani Energy Solutions Limited भारत के power transmission और distribution sector में एक dominant player है जो country के energy infrastructure development में crucial role निभा रही है। Company का ₹81,536 crore order book, 99.7% network availability, और Q1 FY26 का spectacular recovery इसकी fundamental strength को दर्शाता है।

Key Investment Highlights:

- Market Leadership in private transmission sector

- Strong Financial Recovery with positive turnaround

- Massive Growth Pipeline till 2030

- Technology Excellence और operational efficiency

- Strategic Assets including Mumbai distribution utility

Risk Considerations:

- Regulatory challenges और US investigation impact

- High debt levels और execution risk

- Premium valuations और market volatility

Final Investment Verdict: BUY (Long-term)

Recommended Strategy:

- Staggered Entry: SIP mode में invest करें

- Price Targets: ₹1,200-1,400 (12-18 months)

- Hold Period: Minimum 3-5 years

- Portfolio Allocation: 3-5% allocation recommended

Entry Strategy:

- Immediate Entry: For growth-oriented investors

- Correction Entry: ₹650-700 levels for value investors

- SIP Mode: ₹10,000-25,000 monthly for risk management

Adani Energy Solutions India की energy security और infrastructure development का integral part है। Company की strategic position, strong execution capability, और massive growth opportunity को देखते हुए यह long-term wealth creation के लिए एक promising investment opportunity है।

Disclaimer: यह analysis educational purpose के लिए है। Investment decisions से पहले professional financial advice लें और अपनी risk appetite consider करें।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”