3M India Ltd Share Analysis 2025 | Complete Stock Investment Guide Hindi

3M India Limited एक premium multinational conglomerate है जो अपने 60,000+ products के साथ भारतीय बाजार में मजबूत स्थिति बनाए हुए है। यह कंपनी diversified technology और innovation के क्षेत्र में global leader 3M Company (Minnesota, USA) की 75% owned subsidiary है और भारत में industrial excellence का प्रतीक मानी जाती है।

3M India कंपनी का परिचय और Business Model

Historical Background

3M India की शुरुआत 1987 में incorporation के साथ हुई और 1988 में operations शुरू हुआ। कंपनी को 1991 में publicly list किया गया था। शुरुआत में यह Birla 3M Ltd के नाम से Birla Group के साथ joint venture के रूप में काम करती थी, लेकिन बाद में 3M India Ltd नाम अपनाया गया।

Parent Company 3M: Minnesota Mining and Manufacturing Company की स्थापना 1902 में पांच businessmen द्वारा Two Harbors, Minnesota में की गई थी। आज यह Fortune 500 में 102वीं rank पर है और $35.4 billion का annual revenue generate करती है।

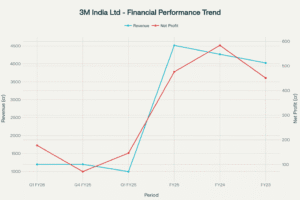

3M India Ltd Financial Performance showing Revenue and Net Profit trends over recent quarters and years

Business Segments और Operations

3M India अपने operations को चार मुख्य business segments में manage करती है:

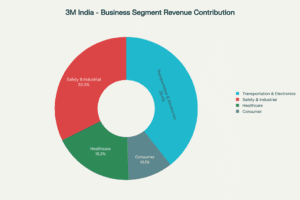

3M India business segment revenue contribution breakdown showing diversified portfolio across four key segments

1. Transportation & Electronics (39% revenue contribution)

- Automotive adhesives और coatings

- Electronics materials

- Transportation safety solutions

- Aerospace applications

2. Safety & Industrial (32% revenue contribution)

- Personal protective equipment (PPE)

- Industrial abrasives और adhesives

- Roofing granules

- Closure systems

3. Healthcare (18% revenue contribution)

- Medical और surgical supplies

- Infection prevention products

- Drug delivery systems

- Dental और orthodontic products

4. Consumer (10% revenue contribution)

- Post-it Notes और Scotch Tape

- Home care products

- Office supply products

- Stationery items

Manufacturing और R&D Infrastructure

कंपनी के पास भारत में strategic locations पर manufacturing facilities हैं:

- Ahmedabad (Gujarat)

- Bengaluru (Karnataka)

- Pune (Maharashtra)

- Corporate Office और R&D Center: Bengaluru

3M India अपने total revenue का 6.2% R&D activities में invest करती है, जिसके result में company के पास 55,000+ products का global portfolio है।

Financial Performance और Growth Analysis

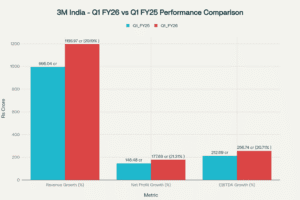

3M India quarterly performance comparison showing strong year-over-year growth in Q1 FY26

Q1 FY26 Outstanding Results

3M India ने Q1 FY26 में exceptional performance deliver किया है:

Key Highlights:

- Revenue: ₹1,195.97 crore (20.19% YoY growth)

- Net Profit: ₹177.69 crore (21.3% YoY growth)

- EBITDA: ₹256.74 crore (20.71% YoY growth)

- EBITDA Margin: 21.46% (vs 21.38% last year)

- EPS: ₹157.73 (vs ₹130.03 last year)

Multi-year Financial Trend

Revenue Performance:

- FY25: ₹4,515.82 crore (13.06% growth)

- FY24: ₹4,267.65 crore (5.96% growth)

- FY23: ₹4,027.46 crore

- 3-year Revenue CAGR: 12.1%

Profitability Trend:

- FY25: ₹476.07 crore PAT

- FY24: ₹583.42 crore PAT

- FY23: ₹451.02 crore PAT

Segment-wise Growth Performance

सभी four business segments में positive growth देखी गई Q1 FY26 में:

- Healthcare और Consumer: दोनों 20% growth

- Safety & Industrial: 11.9% growth

- Transportation & Electronics: 11.2% growth

यह balanced growth company के diversified business model की strength को दर्शाता है।

Key Financial Metrics और Valuation

Current Market Metrics

- Current Price: ₹30,350 (August 2025)

- Market Cap: ₹34,189 crore

- 52-Week Range: ₹25,718 – ₹37,918

- P/E Ratio: 68.85

- P/B Ratio: 18.60

- Book Value: ₹1,639

- ROE: 25.78%

- Beta: 0.51 (low volatility)

- Dividend Yield: 1.76%

Profitability Metrics

- EBITDA Margin: 21.46%

- Net Profit Margin: 14.86%

- Operating Margin: 20.21%

- Return on Assets: Strong asset utilization

- Debt-to-Equity: 0.00 (completely debt-free)

Company की debt-free status और consistent profitability इसकी financial strength को दर्शाती है।

Management Team और Leadership

Managing Director: Ramesh Ramadurai

Professional Background:

- 3M India के साथ 35+ years का experience (1989 से)

- Sales Engineer से Managing Director तक का journey

- Global experience: 3M Philippines MD (2011-2014), 3M China Business Director (2014-2019)

- 3M USA Headquarters में विभिन्न managerial positions

- Current tenure: June 2019 से Managing Director, 2024 तक re-appointed

Educational Qualifications:

- IIM Calcutta से PGDM (Marketing specialization)

- IIT Kanpur से B.Tech (Chemical Engineering)

Industry Recognition:

- CII Karnataka State Council Chairman (FY 21-22)

- US India Business Council के India Advisory Committee member

यह experienced leadership और deep industry knowledge company के growth trajectory के लिए crucial factors हैं।

Competitive Landscape और Market Position

Major Competitors

Adhesives और Industrial Products Segment:

- Asian Paints Ltd (Apcolite brand)

- Pidilite Industries (Fevicol, M-Seal)

- Henkel Adhesives Technologies India

- Huntsman Advanced Materials

- Sika India Pvt Ltd

Competitive Advantages

1. Product Diversification: 60,000+ products across multiple segments

2. Global Technology Access: Parent company के technology resources

3. Strong Brand Portfolio: Scotch, Post-it जैसे globally recognized brands

4. R&D Capabilities: Continuous innovation और product development

5. Manufacturing Excellence: Multiple facilities across India

6. Debt-free Operations: Financial stability और flexibility

Market Share और Position

- Industrial Adhesives: Significant market share

- Personal Protection Equipment: Leading position

- Healthcare Products: Growing market presence

- Consumer Stationery: Strong brand recognition

Growth Prospects और Future Outlook

Analyst Projections

Growth Expectations (Next 3-5 years):

- Revenue Growth CAGR: 10.9%

- Earnings Growth CAGR: 19.9%

- EPS Growth CAGR: 19.9%

- Future ROE: 35.5%

Key Growth Drivers

1. Infrastructure Development: Government’s focus on infrastructure projects

2. Healthcare Expansion: Growing healthcare market in India

3. Automotive Growth: Electric vehicle revolution और automotive sector expansion

4. Digital Transformation: Technology adoption across industries

5. Manufacturing Boost: Make in India initiatives

Strategic Initiatives

Investment Focus Areas:

- Plant Capacity Expansion: विभिन्न manufacturing facilities का expansion

- Technology Advancement: Transportation electronics और healthcare में नई technologies

- Sustainability: Eco-friendly products और sustainable practices

- Digital Infrastructure: E-commerce और digital channels का expansion

Risk Factors और Challenges

Market Risks

1. Economic Slowdown: GDP growth में कमी का business पर प्रभाव

2. Raw Material Cost Inflation: Input costs में वृद्धि से margin pressure

3. Currency Fluctuations: Parent company से imports के कारण forex risk

4. Competition: Local और international competitors से increasing competition

Operational Risks

1. Supply Chain Disruptions: Global supply chain issues का प्रभाव

2. Regulatory Changes: Environmental और industrial regulations में changes

3. Talent Retention: Skilled workforce को retain करने की challenge

4. Technology Disruption: नई technologies से traditional products का displacement

Valuation Concerns

1. High P/E Ratio: 68.85 P/E industry average से significantly higher

2. Premium Valuation: Current price levels पर limited upside potential

3. Market Expectations: High growth expectations को meet करने का pressure

Recent Developments और News

Q4 FY25 Challenges

Profit Decline: Q4 FY25 में PAT में significant decline (₹71.37 crore) देखी गई, जो lowest quarterly profit था। यह mainly higher tax expenses के कारण था।

Strategic Focus Areas (2024-25)

1. Investment Expansion: Plant capacities और technology advancement में बढ़े निवेश

2. Digital Transformation: E-commerce platforms और digital channels का development

3. Sustainability Initiatives: Environment-friendly products का focus

4. Regulatory Compliance: Changing regulations के साथ alignment

Investment Thesis और Recommendation

Strengths

✅ Global Brand Heritage: 120+ years का global experience

✅ Diversified Portfolio: Multiple segments में presence

✅ Innovation Focus: Strong R&D और new product development

✅ Financial Stability: Debt-free operations और consistent profitability

✅ Market Leadership: Premium positioning और brand recognition

✅ Experienced Management: Proven leadership track record

✅ Parent Company Support: Global technology और resources access

Concerns

⚠️ High Valuation: P/E ratio 68.85 (expensive compared to peers)

⚠️ Cyclical Nature: Economic cycles का business performance पर प्रभाव

⚠️ Growth Dependency: Parent company के global performance पर dependence

⚠️ Competition: Increasing competition से margin pressure

⚠️ Currency Risk: Import dependency से forex exposure

Investment Rating: HOLD (Current Levels)

Target Price Range: ₹28,000 – ₹32,000 (12-18 months)

Investment Strategy

For Different Investor Types:

1. Long-term Investors (5+ years):

- Buy on Dips strategy recommended

- Target accumulation at ₹28,000-29,000 levels

- Focus on dividend yield और consistent returns

2. Growth Investors:

- Current levels expensive – wait for correction

- Monitor quarterly results closely

- Focus on segment-wise growth trends

3. Value Investors:

- Avoid at current valuations

- Wait for market correction (₹25,000-27,000 levels)

- Focus on P/E normalization

निष्कर्ष

3M India Limited एक fundamentally strong company है जो global heritage, diversified business model, और innovation focus के साथ भारतीय बाजार में established position रखती है। Company का debt-free operations, consistent profitability, और experienced management इसकी key strengths हैं।

हालांकि Q1 FY26 results impressive हैं और future growth prospects positive लगते हैं, लेकिन current valuations stretched हैं। P/E ratio 68.85 industry standards से काफी higher है, जो near-term upside को limit करता है।

Investment Recommendation:

- Current investors: HOLD करें और quarterly performance monitor करते रहें

- New investors: Market correction का wait करें या SIP mode में invest करें

- Target levels: ₹28,000-29,000 पर accumulate करें

Long-term perspective से 3M India एक quality stock है जो patient investors के लिए good returns generate कर सकती है, बशर्ते reasonable valuations पर entry मिले।

Disclaimer: यह analysis educational purpose के लिए है। Investment decisions से पहले professional financial advice लें और अपनी risk appetite consider करें।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”