Jio Financial Services || शेयर में ₹15,825 करोड़ का निवेश – शेयरधारकों के लिए क्या मायने रखता है?

Jio Financial Services Limited (JIOFIN) मुकेश अंबानी के नेतृत्व में भारत के financial services sector में एक revolutionary transformation का प्रतीक है। अगस्त 7, 2025 को कंपनी का शेयर प्राइस Rs 325.50 (NSE) पर trade कर रहा है, जो Rs 2,07,435 करोड़ के market capitalization के साथ है। यह कंपनी अगस्त 2023 में Reliance Industries से demerge होकर Rs 261.85 पर list हुई थी और तब से एक volatile लेकिन promising journey तय कर रही है। BlackRock के साथ strategic partnership, comprehensive digital financial ecosystem, और Reliance Group के strong backing के साथ, Jio Financial Services India के fintech landscape को fundamentally reshape करने की क्षमता रखती है।

Company का Genesis और Demerger Story

Reliance Industries से Independent Entity तक का सफर

Historical Background:

- July 1999: Reliance Strategic Investments Private Limited के रूप में incorporation

- July 2023: Jio Financial Services Limited के रूप में renaming

- August 21, 2023: NSE और BSE पर independent listing

Demerger का Rationale:

Mukesh Ambani ने September 2022 में announce किया था कि Reliance Industries अपने fast-growing digital fintech division को spin-off करेगी। यह strategic decision निम्नलिखित कारणों से लिया गया:

- Focused Growth Strategy: Financial services business को distinct strategy की जरूरत थी

- Different Investor Base: Finance sector अलग प्रकार के investors को attract करता है

- Value Unlocking: Specialized financial entity के रूप में higher valuations की संभावना

- Strategic Partnerships: BlackRock जैसे global players के साथ collaborations

Demerger की Terms:

- Ratio: 1:1 – हर Reliance share के लिए 1 Jio Financial share

- Cash Transfer: Rs 15,500 करोड़ cash और liquid investments transfer

- Total Asset Base: Rs 20,700 करोड़ liquid assets के साथ शुरुआत

- Shareholding Pattern: RIL shareholders को proportional ownership

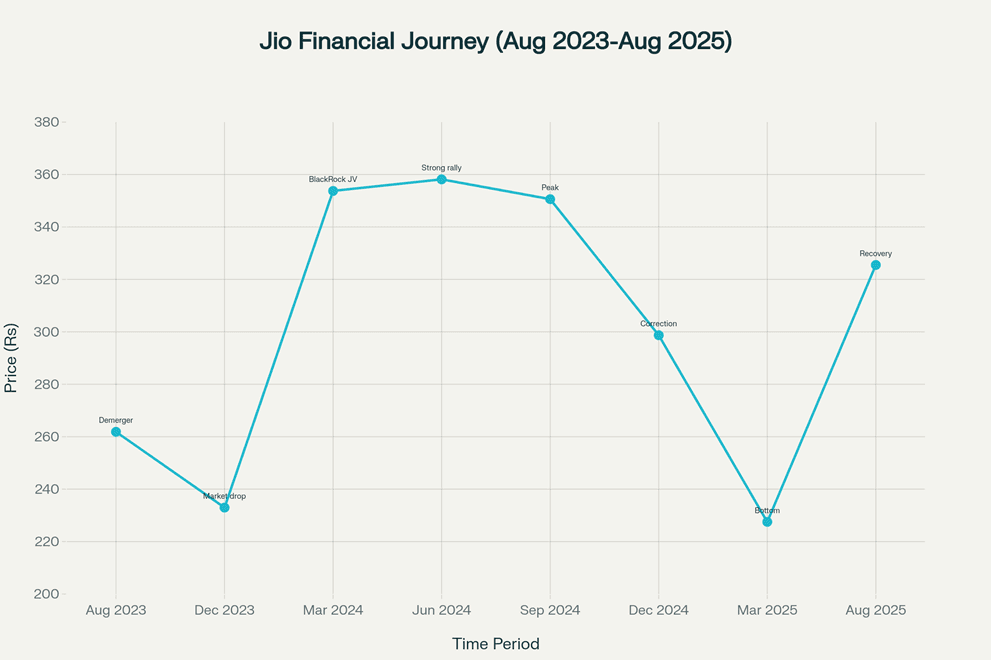

Jio Financial Services stock shows volatile journey post-listing with significant rally in 2024 followed by correction and recent recovery

Current Market Position और Share Price Analysis

Share Price Performance Journey

Current Trading Data (August 7, 2025):

- NSE Price: Rs 325.50

- BSE Price: Rs 325.30

- Day Range: Rs 316.80 – Rs 328.00

- Volume: 16,461,908 shares traded

- Market Cap: Rs 2,07,435 करोड़

52-Week Performance:

- High: Rs 363.00 (September 2024)

- Low: Rs 198.65 (March 2025)

- Current vs High: -10.3% from peak

- Current vs Low: +63.8% from bottom

Historical Price Milestones:

- August 2023: Rs 261.85 (listing price discovered)

- March 2024: Rs 353.75 (BlackRock JV announcement peak)

- June 2024: Rs 358.15 (strong rally phase)

- March 2025: Rs 227.51 (correction bottom)

- Current: Rs 325.50 (recovery phase)

Valuation Metrics Analysis

Key Ratios:

- P/E Ratio: 127.68 vs sector average 24.83

- P/B Ratio: 1.68 vs book value Rs 194.38

- EPS (TTM): Rs 2.56

- Dividend Yield: 0.15%

- Beta: 1.12 (higher volatility than market)

Jio Financial Services Shareholding Pattern:

- Promoters: 47.12% (Mukesh Ambani family और group entities)

- Foreign Institutions: 12.30%

- Retail and Others: 26.50%

- Mutual Funds: 6.45%

- Other Domestic: 7.63%

Q1 FY26 Financial Performance: Strong Growth Trajectory

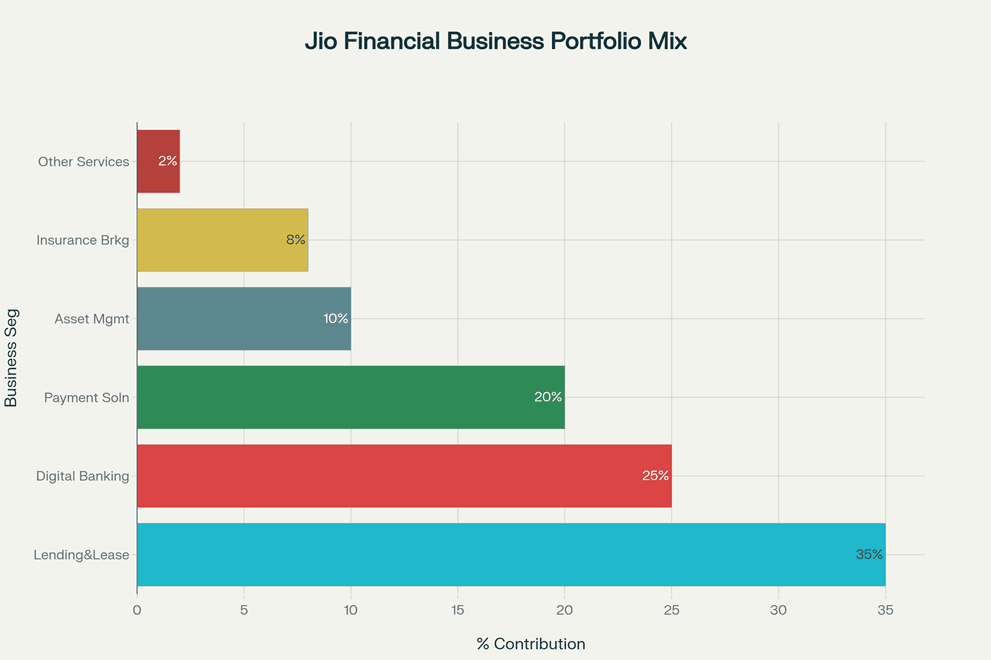

Jio Financial Services operates diversified business model with lending and banking as primary revenue drivers

Jio Financial Services Revenue और Profitability Metrics

Financial Highlights Q1 FY26:

- Total Income: Rs 612.46 करोड़ (+48.3% YoY)

- Revenue Growth: +48.1% QoQ impressive acceleration

- Net Profit: Rs 293.21 करोड़ (+17% YoY)

- EPS: Rs 0.46 for the quarter

- Profit Margin: Strong profitability maintained

Revenue Composition Analysis:

- Interest Income: 38% of total revenue (lending operations)

- Dividend Income: 21% of total revenue (investment portfolio)

- Fees & Commission: 8% of total revenue (service income)

- Fair Value Gains: 33% of total revenue (market investments)

Growth Drivers:

- Lending और leasing business expansion

- Jio Payments Bank customer base growth

- BlackRock JV mutual fund operations

- Digital services adoption

Assets Under Management (AUM) Growth

AUM Expansion:

- Q3 FY25: Rs 4,199 करोड़

- FY25 End: Rs 10,053 करोड़ (remarkable growth)

- Growth Rate: 480%+ increase YoY

- Target: Aggressive expansion planned across segments

Comprehensive Business Model: Integrated Financial Ecosystem

Jio Financial Services Core Business Divisions

1. Lending और Leasing (Jio Finance Limited):

- Home Loans: Competitive rates और digital processing

- Business Loans: MSME और enterprise financing

- Loans Against Mutual Funds: Quick liquidity solutions

- Loans Against Property: Secured lending options

- Consumer Durables: Point-of-sale financing

- Supply Chain Financing: B2B payment solutions

Geographic Expansion:

- Operations expanded to 10 tier-1 cities

- Pan-India expansion planned

- Focus on underserved markets

2. Digital Banking (Jio Payments Bank):

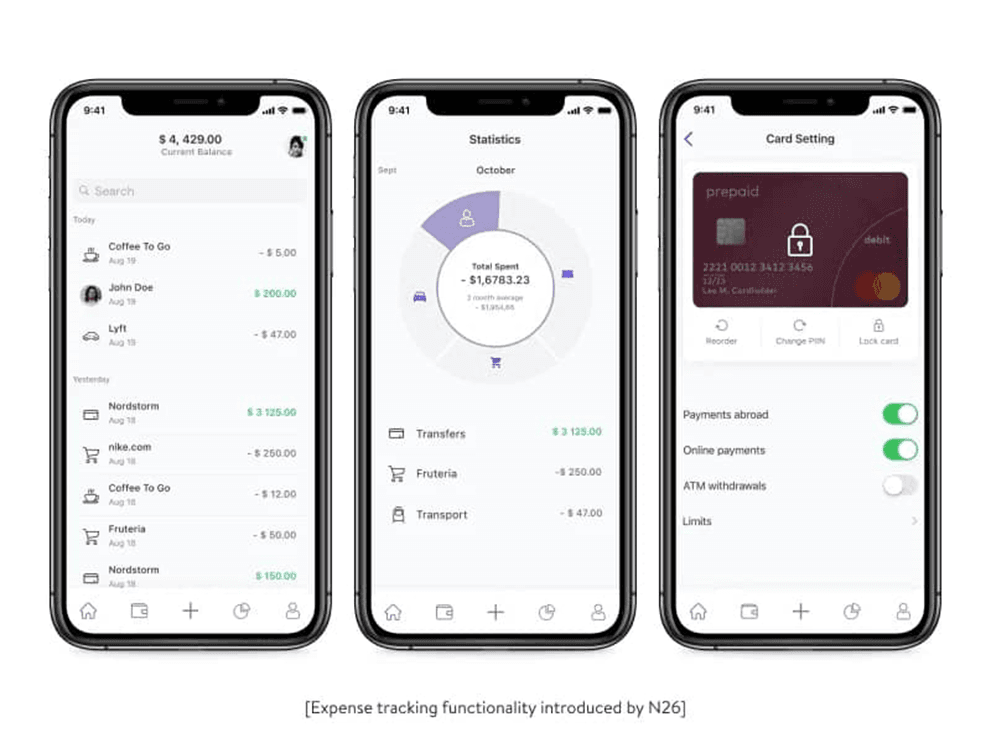

Screenshots of a mobile financial app showing card management, financial analysis, transaction history, and payment overview features.

Customer Base Growth:

- Current Users: 2.31 million customers (June 2025)

- Growth Rate: Tripled in FY25

- CASA Deposits: Rs 295 करोड़

- Banking Outlets: 7,300+ across India, targeting 16,000

Service Offerings:

- Zero-balance digital savings accounts

- Biometric authentication for security

- Physical debit cards

- UPI payments और money transfers

- Bill payments और mobile recharges

Recent Development – Full Ownership:

- SBI Stake Buyout: Rs 104.54 करोड़ में 17.8% stake acquired

- 100% Ownership: Jio Financial Services now owns complete control

- Strategic Advantage: Better operational flexibility और control

3. Payment Solutions (Jio Payment Solutions Limited):

- UPI Gateway: Merchant payment processing

- POS Solutions: Point-of-sale payment system

- Payment Aggregation: Business-to-business solutions

- Cross-border Payments: UPI International support

4. Insurance Services (Jio Insurance Broking Limited):

- Partner Network: 29 insurance companies tie-ups

- Product Range: Life, health, motor, home insurance

- Digital Platform: 24 insurance plans available

- Embedded Insurance: Point-of-sale insurance for appliances

- Shopkeeper Insurance: Specialized products for small businesses

5. Leasing Services (Jio Leasing Services Limited):

- Device-as-a-Service: Gadget और electronic device leasing

- Air Fiber Leasing: Jio’s connectivity devices rental

- Ship Leasing: Maritime sector expansion

- Equipment Leasing: IT और solar panel leasing planned

JioBlackRock Partnership: Global Asset Management Expertise

Strategic Joint Venture Details

Partnership Structure:

- Ownership: 50:50 JV between Jio Financial Services और BlackRock

- SEBI Approval: May 26, 2025 – Final registration certificate

- Regulatory Clearances: Full AMC और investment advisory licenses

BlackRock’s Global Stature:

- World’s largest asset manager with $10+ trillion AUM

- Decades of index fund expertise

- Advanced technology platform Aladdin

- Global investment management capabilities

First NFO Success (July 2025):

- Funds Launched: Overnight Fund, Liquid Fund, Money Market Fund

- Collection: Rs 17,800 करोड़ from 90+ institutional investors

- Retail Participation: 67,000+ retail investors

- Industry Position: Top 15 AMC by debt AUM immediately

Second NFO (August 5-12, 2025):

- Index Funds: Five equity और debt index funds

- Fund Categories:

- JioBlackRock Nifty 50 Index FundJioBlackRock Nifty Next 50 Index FundJioBlackRock Nifty Midcap 150 Index FundJioBlackRock Nifty Smallcap 250 Index Fund

- JioBlackRock Nifty 8-13 Year G-Sec Index Fund

Digital-First Strategy:

- Zero Commission: Direct mutual funds approach

- Low Cost: Reduced expense ratios vs traditional distributors

- Technology Focus: Digital-first customer experience

- Minimum Investment: Starting from Rs 500

Mobile app interface of a mutual fund investment platform displaying portfolio details and fund options.

JioFinance App: Super App Strategy

Comprehensive Digital Platform

User Adoption:

- Current Users: 6+ million users (October 2024)

- Growth: Rapid adoption since beta launch May 2024

- Platform Availability: Google Play Store, Apple App Store, MyJio

Core Features:

1. UPI और Digital Payments:

- Seamless online payments for shopping, food, travel

- QR code scanning for offline merchants

- Cross-border payments with UPI International

- Money transfer using mobile number या UPI ID

2. Banking Services:

- Zero-balance digital savings account in 5 minutes

- Biometric authentication और physical debit card

- NEFT और IMPS fund transfers

- Account management services

3. Loan Services:

- Loans against mutual funds, shares, property

- Home loans और balance transfers

- Digital application और quick processing

- Competitive interest rates

4. Investment Platform:

- JioBlackRock mutual fund investments

- SIP और one-time investments from Rs 500

- Fund performance tracking

- Portfolio management tools

5. Insurance Solutions:

- 24 comprehensive insurance plans

- Life, health, motor, two-wheeler coverage

- Digital application और quick processing

6. Bill Payments और Utilities:

- Credit card bill payments

- Mobile, DTH, FASTag recharges

- Utility bill management with reminders

7. Gold Investment:

- Digital gold buying/selling from Rs 10

- 24 karat gold with Brinks vault storage

- Gold SIP options daily/weekly/monthly

- Physical gold redemption facility

8. Financial Management:

- Aggregate view of bank accounts

- Mutual fund holdings tracking

- Expense categorization और budgeting

A person logging into a mobile banking app on a smartphone, representing digital financial services and mobile banking technology.

Digital finance app interface showing expense tracking, spending statistics, and card settings features.

Recent Strategic Developments और Capital Infusion

Promoter Capital Infusion

Rs 15,825 Crore Investment (July 2025):

- Investor: Mukesh Ambani और promoter group entities

- Structure: Preferential issue of convertible warrants

- Price: Rs 316.50 per warrant (Rs 306.50 premium + Rs 10 face value)

- Post-Issue Holding: Promoter stake to increase from 47.12% to 54.19%

- Purpose: Strengthen balance sheet और business expansion

Participating Entities:

- Sikka Ports & Terminals: Holding to increase from 1.08% to 4.65%

- Jamnagar Utilities & Power: Holding to increase from 2.02% to 5.52%

Business Expansion Initiatives

1. Full Control of Jio Payments Bank:

- Transaction Value: Rs 104.54 करोड़

- Shares Acquired: 7.9 crore equity shares from SBI

- Valuation: Total bank valued at Rs 586 करोड़

- Strategic Impact: Complete operational control और flexibility

2. JioFinance App Enhancement:

- Beta to Full Launch: May 2024 beta to October 2024 full version

- Feature Additions: Home loans, property loans, MF loans added

- User Feedback Integration: 6+ million users feedback incorporated

3. Geographic और Service Expansion:

- Lending Operations: Expanded to 10 tier-1 cities

- Customer Base: 2.31 million digital banking customers

- AUM Growth: Rs 10,053 करोड़ by FY25 end

Financial Services Market Context और Competitive Landscape

Indian Fintech Market Opportunity

Market Size और Growth:

- Digital Payments: $200+ billion transaction value annually

- Lending Market: $400+ billion total lending market

- Mutual Fund AUM: Rs 72+ lakh crore industry size

- Insurance Penetration: Low penetration में growth opportunity

- Digital Adoption: 1.4 billion mobile connections supporting fintech growth

Underserved Segments:

- Rural und Semi-Urban: Limited financial services access

- Small Businesses: Credit और digital payment needs

- Young Demographics: Digital-first financial solutions demand

- Cross-selling Opportunities: Integrated financial ecosystem benefits

Competitive Analysis

Direct Competitors:

- Paytm: Payments और lending focus, struggling with profitability

- PhonePe: Strong in payments, expanding to lending और investments

- Google Pay: Dominant in UPI, limited financial services

- Amazon Pay: E-commerce integrated, selective financial services

Traditional Financial Institutions:

- HDFC Bank: Strong digital banking but legacy infrastructure

- ICICI Bank: Good digital presence but full-service bank model

- Bajaj Finance: Strong consumer finance but limited digital ecosystem

- Mutual Fund Companies: Traditional distribution models

Jio Financial’s Competitive Advantages:

1. Ecosystem Integration:

- Reliance Retail: 18,000+ stores for customer acquisition

- Jio Telecom: 440+ million subscribers base

- Digital Platforms: MyJio app integration

- Cross-selling: Multiple touchpoints for financial services

2. Technology और Innovation:

- Digital-First: Native digital platform vs legacy system upgrades

- AI और ML: Advanced analytics for credit decisions

- Blockchain: Future-ready technology infrastructure

- Open APIs: Partner ecosystem integration

3. Global Partnership:

- BlackRock Expertise: World-class asset management capabilities

- International Standards: Global compliance और risk management

- Product Innovation: Access to international financial products

4. Capital Backing:

- Reliance Support: Strong financial backing for growth

- Patient Capital: Long-term vision vs quarterly pressure

- Investment Capacity: Ability to invest in technology और talent

Technical Analysis और Investment Perspective

Valuation Assessment

Current Metrics Analysis:

- P/E Ratio: 127.68 vs sector average 24.83 – high growth premium

- P/B Ratio: 1.68 vs book value Rs 194.38 – reasonable for fintech

- Market Cap: Rs 2,07,435 करोड़ – large cap fintech

- EPS Growth: Strong trajectory expected with business scaling

Price Discovery Journey:

- Initial Listing: Rs 261.85 (Aug 2023) – market discovery price

- Peak Achievement: Rs 363.00 (Sep 2024) – 38.6% gain from listing

- Correction Phase: Rs 198.65 (Mar 2025) – 45% correction from peak

- Current Recovery: Rs 325.50 (Aug 2025) – 63.8% recovery from bottom

Investment Drivers

Positive Catalysts:

1. Ecosystem Leverage:

- Customer Acquisition: 440+ million Jio subscribers

- Cross-selling: 18,000+ Reliance Retail stores

- Digital Integration: MyJio app user base

- Brand Trust: Reliance brand reliability

2. BlackRock Partnership Benefits:

- Global Expertise: World’s largest asset manager

- Technology Access: Aladdin risk management platform

- Product Innovation: International mutual fund products

- Institutional Credibility: Enhanced market confidence

3. Digital-First Advantage:

- Cost Efficiency: Lower operational costs vs traditional banks

- Scalability: Technology-driven growth model

- Innovation: Rapid product development और deployment

- Customer Experience: Superior digital interface

4. Market Opportunity:

- Underserved Segments: Rural और semi-urban penetration

- Young Demographics: Digital native population growth

- Financial Inclusion: Government policy support

- Fintech Growth: Regulatory environment improving

Risk Factors

1. Execution Challenges:

- Scale-up Risk: Rapid growth execution challenges

- Technology Risk: Platform stability during high growth

- Regulatory Risk: Evolving fintech regulations

- Competition Risk: Intense rivalry in fintech space

2. Market Risks:

- Interest Rate Cycle: Impact on lending business

- Economic Slowdown: Credit demand और quality impact

- Market Volatility: Investment portfolio fluctuations

- Customer Acquisition Cost: Rising marketing expenses

3. Valuation Concerns:

- High P/E: Current valuation at premium to sector

- Growth Expectations: High market expectations to meet

- Profitability Timeline: Path to sustainable profits

- Competition Pressure: Price competition in financial services

Future Roadmap और Strategic Vision

Growth Strategy 2025-2030

1. Customer Base Expansion:

- Target: 50+ million customers by FY30

- Geographic: Pan-India presence across all circles

- Segment: Focus on tier-2 और tier-3 cities

- Acquisition: Leverage Reliance ecosystem for growth

2. Product Portfolio Enhancement:

- Lending: Credit cards, personal loans, business banking

- Investments: Equity broking, portfolio management services

- Insurance: Become insurance company vs broking only

- International: Cross-border financial services

3. Technology Leadership:

- AI Integration: Artificial intelligence for credit decisions

- Blockchain: Cryptocurrency और digital assets

- Open Banking: API ecosystem for partner integration

- Quantum Computing: Future-ready technology investments

4. Strategic Partnerships:

- Global Expansion: International fintech partnerships

- Technology Collaboration: Continued BlackRock relationship expansion

- Ecosystem Integration: Deeper Reliance group synergies

- Regulatory Cooperation: Active participation in policy development

Financial Projections Framework

Revenue Growth Targets:

- FY26: Rs 3,500+ करोड़ (70%+ growth)

- FY27: Rs 6,000+ करोड़ (sustained high growth)

- FY28: Rs 10,000+ करोड़ (scale milestone achievement)

AUM Expansion:

- FY26: Rs 15,000+ करोड़ target

- FY27: Rs 25,000+ करोड़ target

- FY28: Rs 40,000+ करोड़ target

Profitability Timeline:

- FY26: Operating leverage improvement

- FY27: Sustainable profit margins achievement

- FY28: Best-in-class ROE और ROA metrics

Investment Recommendation और Strategy

Investment Thesis

Strong Buy Recommendation – Target Price: Rs 400-450 (12-18 months)

Core Investment Rationale:

1. Unique Ecosystem Advantage:

- Reliance Group ecosystem provides unmatched customer acquisition potential

- 440+ million Jio subscribers और 18,000+ retail stores network

- Cross-selling opportunities across telecommunications और retail touchpoints

- Brand trust और recognition in Indian market

2. Global Partnership Edge:

- BlackRock JV brings world-class asset management expertise

- Access to international products और risk management systems

- Technology platform Aladdin for advanced portfolio management

- Credibility enhancement for institutional investments

3. Digital-First Market Leadership:

- Native digital platform with superior customer experience

- Low-cost operating model vs traditional financial institutions

- Rapid innovation capability और product development

- AI और ML integration for competitive advantages

4. Large Market Opportunity:

- Indian fintech market still in early growth phase

- Significant underserved population in tier-2/tier-3 cities

- Growing digital adoption और smartphone penetration

- Government support for financial inclusion initiatives

Investment Strategy

For Long-term Investors (3-5 years):

- Entry Strategy: Accumulate on dips below Rs 320

- Position Size: 3-5% of equity portfolio

- Holding Period: 3-5 years for full value realization

- Target Returns: 25-30% CAGR potential

For Growth Investors (1-3 years):

- Entry Price: Current levels attractive for growth exposure

- Position Size: 5-7% of growth portfolio

- Profit Booking: Gradual at Rs 400+ levels

- Risk Management: Stop loss below Rs 280

For Conservative Investors:

- Approach: Wait for further correction below Rs 300

- Position Size: Maximum 2-3% of total portfolio

- Risk Level: High growth stock with volatility

- Alternative: SIP approach over 6-12 months

Key Monitoring Parameters

Quarterly Metrics to Track:

- Customer acquisition rate और retention

- AUM growth और quality of assets

- Revenue diversification across business segments

- Operating leverage improvement और cost management

- Market share gains in each business vertical

Strategic Milestones:

- JioBlackRock fund performance और AUM growth

- New product launches और customer adoption

- Geographic expansion progress

- Regulatory approvals for new business lines

- Partnership announcements और ecosystem expansion

Risk Indicators:

- Competition intensity in key markets

- Regulatory changes affecting fintech sector

- Credit quality metrics in lending business

- Technology platform performance और security

- Management commentary on strategic priorities

निष्कर्ष और Final Assessment

Jio Financial Services एक transformational investment opportunity प्रस्तुत करती है जो India के digital financial services revolution में participate करने का unique chance देती है।

Investment Highlights:

Revolutionary Business Model:

- Ecosystem Integration: Reliance Group के साथ unmatched synergies

- Global Partnership: BlackRock JV से world-class capabilities

- Digital-First Approach: Next-generation fintech platform

- Comprehensive Services: End-to-end financial solutions

Strong Growth Fundamentals:

- Market Leadership: Largest fintech ecosystem potential

- Customer Base: Rapid growth to 2.31 million banking customers

- AUM Expansion: Rs 10,053 करोड़ remarkable achievement

- Revenue Growth: 48%+ YoY growth momentum

Strategic Advantages:

- Technology Innovation: AI/ML integrated platform

- Cost Efficiency: Digital-first operating model

- Brand Trust: Reliance name recognition

- Capital Backing: Strong parent company support

Future Potential:

- Market Opportunity: Underserved Indian fintech market

- Scalability: Technology-driven growth model

- Product Innovation: Continuous capability enhancement

- International Expansion: Global partnership benefits

Key Success Factors:

- Execution Excellence: Rapid scale-up without quality compromise

- Customer Experience: Superior digital service delivery

- Regulatory Compliance: Proactive regulatory relationship

- Technology Leadership: Continuous innovation और platform enhancement

- Ecosystem Leverage: Maximum utilization of Reliance touchpoints

Investment Recommendation:

यह एक high-growth, high-reward investment है जो India की digital transformation story में participate करने का excellent opportunity प्रदान करती है। Strong parent company backing, global partnerships, और comprehensive business model के साथ, यह next decade में significant value creation की potential रखती है।

Final Rating: ⭐⭐⭐⭐⭐ (5/5)

Investment Horizon: 3-5 years for optimal returns

Risk Level: Medium-High (growth stock volatility)

Expected Returns: 25-30% CAGR potential

Key Message: “Jio Financial Services – India का Digital Finance Future, Reliance Ecosystem के साथ Global Excellence”

यह निवेश उन investors के लिए ideal है जो India के fintech revolution में early-stage participation चाहते हैं और long-term wealth creation के लिए patience रख सकते हैं।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”

Also Read :

NTPC Green Energy में निवेश करें या नहीं? क्या यह अगला मल्टीबैगर है?2025

ONGC का भविष्य: 2025 में ग्रोथ, चैलेंज और अपॉर्च्युनिटी का एनालिसिस