IDFC First Bank Share में निवेश करें या नहीं? पूरी जानकारी 2025

आईडीएफसी फर्स्ट बैंक लिमिटेड (IDFC First Bank) भारत की एक तेजी से बढ़ती प्राइवेट सेक्टर बैंक है, जो अपने digital-first approach और innovative banking solutions के लिए जानी जाती है। 2025 में Warburg Pincus और Abu Dhabi Investment Authority (ADIA) से ₹7,500 करोड़ का निवेश प्राप्त करने के साथ, बैंक अपने transformation journey में एक नया अध्याय शुरू कर रहा है। वर्तमान में ₹50,849 करोड़ के market cap के साथ यह भारत का 17वां सबसे बड़ा बैंक है।

IDFC First Bank का ऐतिहासिक सफर: From Infrastructure to Retail Banking

स्थापना और प्रारंभिक चरण (1997-2015)

IDFC Limited की शुरुआत 1997 में भारत सरकार द्वारा infrastructure projects को finance करने के लिए एक Development Financial Institution (DFI) के रूप में हुई थी। कंपनी का initial focus project finance और infrastructure development पर था।

Key Milestones (1997-2015):

- 2005: Government और IDBI Bank sponsor shareholders के रूप में

- 2005: IPO के माध्यम से public listing

- 2014: RBI से banking license के लिए in-principle approval

- 2015: Asset management, institutional broking में diversification

Banking Journey की शुरुआत (2015-2018)

1 अक्टूबर 2015 को IDFC Bank officially operations शुरू किया। Prime Minister Narendra Modi ने bank को inaugurate किया था। Initially, bank का 90% business wholesale (infrastructure और corporate loans) था।

Early Banking Challenges:

- Low CASA Ratio: केवल 8.2% (September 2017)

- Limited Retail Presence: Infrastructure lending में legacy focus

- Bad Loans: Legacy infrastructure accounts से NPA issues

- Merger Plans: Shriram Group के साथ planned merger cancelled

Historic Merger: Capital First Integration (2018)

13 जनवरी 2018 को IDFC Bank और Capital First ने merger announcement की। यह Indian banking history का एक significant merger था।

Merger Details:

- Share Swap Ratio: 139 IDFC Bank shares for every 10 Capital First shares

- Completion Date: 18 दिसंबर 2018

- New Identity: IDFC FIRST Bank

- Leadership: V. Vaidyanathan MD & CEO बने

Capital First की Legacy:

- Founded: 2005 (Future Group के part के रूप में)

- Transformation: 2012 में Warburg Pincus acquisition

- Expertise: Retail lending और microfinance में specialization

- Customer Base: 70+ lakh customers including 30 lakh rural customers

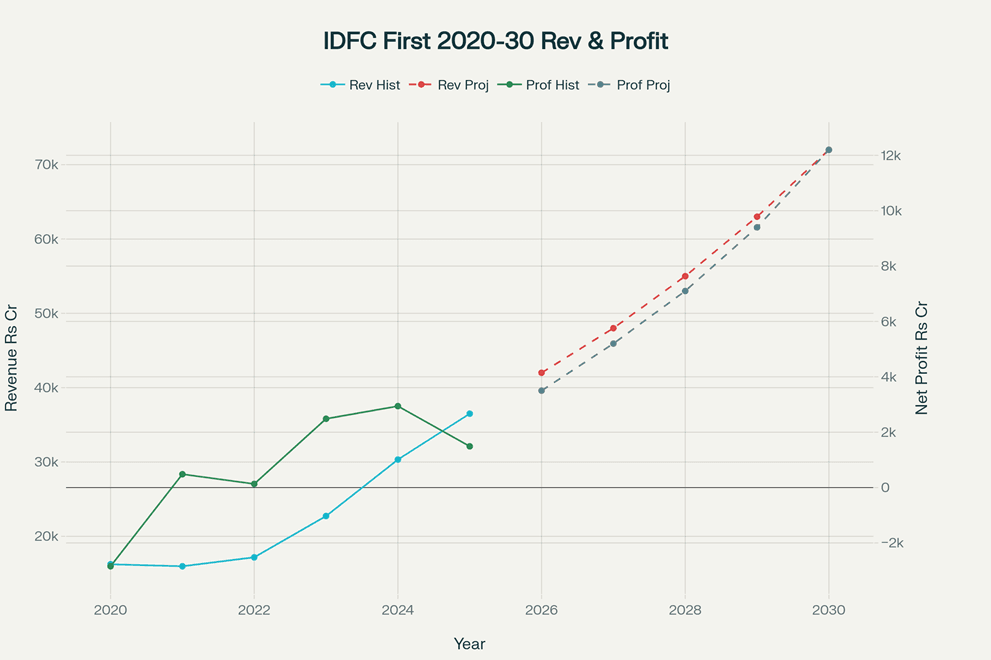

IDFC First Bank का वित्तीय विकास: 2020-2030 (ऐतिहासिक और प्रक्षेपित)

Business Model Transformation: Infrastructure से Retail Banking

Pre-Merger vs Post-Merger Comparison

IDFC Bank (Pre-2018):

- Business Focus: 90% wholesale lending

- Spread: केवल 1.7%

- Customer Base: Corporate और infrastructure clients

- CASA: Extremely low at 8.2%

IDFC FIRST Bank (Post-2018):

- Business Focus: 80% retail deposits target

- Spread: 3.3% से 5.6% तक improvement potential

- Customer Base: 3.55 crore live customers

- CASA: 48% तक improvement

Digital-First Banking Strategy

IDFC FIRST Bank ने खुद को “Technology Company with Banking License” के रूप में position किया है:

Technology Initiatives:

- 100% Digital Onboarding: Video KYC, digital account opening

- AI-Powered Customer Service: Chatbots और automated solutions

- Mobile-First Approach: Advanced mobile banking platform

- Open Banking Architecture: Flexible और scalable technology stack

Customer-Centric Innovations:

- Monthly Interest Credit: Savings accounts पर monthly interest

- Zero Fee Structure: Lifetime free credit cards

- 7% Savings Rate: Industry-leading interest rates (initially)

- 24×7 Banking: Digital-first service delivery

Recent Financial Performance और Market Position

Q1 FY26 Results Analysis

26 जुलाई 2025 को announce किए गए Q1 FY26 results mixed performance दिखाते हैं:

Key Financial Metrics:

- Total Income: ₹11,869 करोड़ (+14.5% YoY, +20.3% QoQ)

- Net Profit: ₹463 करोड़ (-32% YoY from ₹681 करोड़)

- Provisions: ₹1,659 करोड़ (+66.8% YoY increase)

- EPS: ₹0.60 (-33.3% YoY from ₹0.90)

Balance Sheet Strength:

- Customer Deposits: ₹2,56,799 करोड़ (+25.5% YoY)

- Retail Deposits: ₹2,04,222 करोड़ (+24.5% YoY)

- CASA Deposits: ₹1,27,158 करोड़ (+30.2% YoY)

- CASA Ratio: 48.0% (46.6% से improvement)

Asset Quality और Risk Management

Asset Quality Trends:

- Gross NPA: 1.97% (June 2025) vs 1.90% (June 2024)

- Net NPA: 0.55% vs 0.59% (slight improvement)

- Provision Coverage: Strong coverage ratios maintained

Microfinance Challenges: Recent quarters में microfinance industry issues का impact देखा गया है, जिससे provisions बढ़े हैं।

Major Strategic Investment: Warburg Pincus और ADIA

₹7,500 करोड़ का Capital Infusion

17 अप्रैल 2025 को IDFC FIRST Bank ने announce किया कि Warburg Pincus और ADIA combined ₹7,500 करोड़ का investment करेंगे:

Investment Breakdown:

- Warburg Pincus: ₹4,876 करोड़ (9.48% stake)

- ADIA: ₹2,624 करोड़ (5.10% stake)

- Structure: Compulsorily Convertible Preference Shares (CCPS)

- Price: ₹60 per share

Regulatory Approvals:

- CCI Approval: 3 जून 2025 को cleared

- RBI Approval: 20 जुलाई 2025 को received

- Shareholder Approval: Mixed results (board seat proposal rejected)

Investment का Strategic Importance

यह investment Indian banking sector में largest private equity investments में से एक है:

Capital Adequacy Impact:

- Current CRAR: 16.4%

- Post-Investment CRAR: ~19% (target)

- Tier-I Ratio: 15.89% maintenance

- Growth Capital: Next phase expansion के लिए

Future Vision और Strategic Roadmap (2025-2030)

5-Year Growth Strategy

IDFC FIRST Bank का ambitious vision है sustainable 15-18% ROE achieve करने का:

2025-2026 Priorities:

- Capital Deployment: ₹7,500 करोड़ का strategic utilization

- Digital Expansion: Technology infrastructure scaling

- Branch Network: Selective expansion in key markets

- Product Launch: New retail और SME products

2026-2028 Medium-term Goals:

- Revenue Target: ₹48,000-₹55,000 करोड़

- ROE Improvement: 10-14% range achievement

- Market Share: Retail banking में significant growth

- Technology Leadership: AI/ML capabilities enhancement

2029-2030 Long-term Vision:

- Revenue Target: ₹72,000 करोड़

- ROE Target: 15-18% sustainable levels

- Premium Positioning: Top-tier private bank status

- Digital Bank: Complete digital transformation

Digital Transformation Roadmap

IDFC FIRST Bank का “Digital-First” strategy comprehensive technology adoption पर based है:

AI और Machine Learning:

- Customer Experience: AI-powered personalization

- Risk Management: Advanced analytics for credit decisions

- Operations: Automated processes और cost optimization

- Fraud Detection: Real-time monitoring systems

Open Banking और API Strategy:

- Fintech Partnerships: Ecosystem integration

- Third-party Integration: Seamless customer journey

- Developer Platform: API marketplace development

- Innovation Labs: Startup collaboration programs

Business Segments और Revenue Diversification

Retail Banking (Core Focus)

Retail segment IDFC FIRST Bank का primary growth driver है:

Retail Products Portfolio:

- Personal Loans: Digital lending platform

- Home Loans: Competitive rates और quick processing

- Credit Cards: Lifetime free rewards program

- Two-Wheeler Loans: Rural और semi-urban focus

- Consumer Durable Loans: Flexible EMI options

Customer Acquisition Strategy:

- Rural Penetration: 500+ rural business correspondent centers

- Urban Expansion: Premium banking services

- Digital Onboarding: Completely paperless processes

- Cross-selling: Existing customer base leverage

Corporate Banking और Treasury

Corporate segment stable revenue stream provide करता है:

Corporate Products:

- Working Capital: Cash credit और overdraft facilities

- Term Loans: Project finance और expansion funding

- Trade Finance: Import-export financing solutions

- Cash Management: Corporate treasury services

Emerging Business Verticals

New Revenue Streams:

- Wealth Management: HNI client focus

- Investment Services: Mutual funds और insurance distribution

- Digital Payment: UPI और payment gateway services

- International Banking: NRI customer segment

Competitive Analysis और Market Positioning

Peer Comparison Analysis

IDFC FIRST Bank का positioning other new-age private banks के साथ:

| मेट्रिक | IDFC FIRST | Kotak Mahindra | Axis Bank | ICICI Bank |

| Market Cap | ₹50,849 Cr | ₹3,25,000 Cr | ₹3,68,000 Cr | ₹10,01,000 Cr |

| P/E Ratio | 39.08 | 20.68 | 11.83 | 19.86 |

| ROE | 4.21% | 15.2% | 14.8% | 17.3% |

| CASA Ratio | 48.0% | 53.1% | 42.1% | 45.8% |

Competitive Advantages

IDFC FIRST Bank के मुख्य strengths:

- Digital Leadership: Technology-first approach

- Capital Infusion: Fresh ₹7,500 करोड़ funding

- Management Expertise: V. Vaidyanathan की proven track record

- Rural Reach: Strong rural banking network

- Innovation Focus: Customer-centric product development

Challenges और Areas for Improvement

Key Challenges:

- Low ROE: 4.21% industry average से काफी कम

- High Cost-to-Income: Operational efficiency improvement needed

- Asset Quality: Recent microfinance provisions impact

- Competition: Intense competition from established players

Technology Innovation और Digital Banking

Core Banking Technology Stack

IDFC FIRST Bank ने modern, scalable technology architecture develop किया है:

Service-Oriented Architecture (SOA):

- Microservices: Flexible और scalable services

- Cloud-Native: AWS और cloud infrastructure

- API-First: Third-party integration capabilities

- Real-time Processing: Instant transaction processing

Customer Experience Technologies:

- Video KYC: Complete digital onboarding

- Biometric Authentication: Enhanced security measures

- Omnichannel Platform: Seamless across all touchpoints

- Predictive Analytics: Personalized product recommendations

Fintech Partnerships और Ecosystem

Strategic Collaborations:

- ToneTag Partnership: Voice-based contactless payments

- CBDC Integration: Digital rupee wallet services

- UPI Innovation: International UPI expansion

- Crunchfish Project: Offline payment solutions pilot

Innovation Initiatives:

- Startup Incubation: Fintech innovation support

- Hackathons: Developer community engagement

- Innovation Labs: Internal R&D programs

- Patent Portfolio: Intellectual property development

Risk Management और Regulatory Compliance

Asset Quality Management

IDFC FIRST Bank का comprehensive risk framework है:

Credit Risk Management:

- Granular Portfolios: Diversified lending approach

- Advanced Analytics: AI-powered risk assessment

- Early Warning Systems: Proactive problem identification

- Collection Efficiency: Technology-enabled recovery

Operational Risk Controls:

- Cyber Security: Multi-layered security architecture

- Fraud Prevention: Real-time monitoring systems

- Compliance Management: Automated regulatory reporting

- Business Continuity: Disaster recovery planning

Regulatory Environment Navigation

RBI Guidelines Compliance:

- Basel III Implementation: Capital adequacy maintenance

- Digital Banking Norms: Technology governance standards

- Customer Protection: Fair practice guidelines

- AML/KYC Compliance: Enhanced due diligence processes

Investment Thesis और Future Outlook

Bull Case Arguments

Positive Investment Factors:

- Capital Strength: ₹7,500 करोड़ fresh funding

- Digital Leadership: Technology-first competitive advantage

- Management Quality: V. Vaidyanathan की proven expertise

- Market Opportunity: India’s banking penetration growth

- Transformation Story: Infrastructure से retail banking shift

Bear Case Concerns

Risk Factors:

- Valuation Premium: P/E 39.08 vs industry average

- Low Profitability: ROE 4.21% improvement needed

- Execution Risk: Digital transformation challenges

- Competitive Pressure: Intense market competition

- Asset Quality: Microfinance segment concerns

Expert Recommendations और Target Prices

19 analysts में से majority ने “BUY” rating दी है:

Consensus View:

- Average Target: ₹78.7 (13% upside potential)

- Range: ₹72-₹85

- Recommendation: BUY (11 analysts), HOLD (8 analysts)

- Time Horizon: 12-18 months

Conclusion और Strategic Outlook

IDFC FIRST Bank का journey infrastructure financing DFI से modern digital bank बनने तक remarkable transformation story है। Warburg Pincus और ADIA का ₹7,500 करोड़ investment bank के growth trajectory को significantly accelerate करेगा।

Key Investment Highlights:

- Digital Transformation: Technology-first approach से competitive advantage

- Capital Infusion: Strong balance sheet और growth funding

- Management Expertise: V. Vaidyanathan की proven track record

- Market Opportunity: India’s retail banking growth story alignment

- Strategic Vision: Clear roadmap to 15-18% ROE achievement

Near-term Catalysts:

- Capital Deployment: ₹7,500 करोड़ का strategic utilization

- Digital Expansion: Technology capabilities scaling

- Product Innovation: New retail banking offerings

- Market Share Gains: Competitive positioning improvement

Long-term Vision (2030):

- Revenue: ₹72,000 करोड़ target

- ROE: 15-18% sustainable profitability

- Digital Leadership: Technology-driven banking excellence

- Market Position: Top-tier private bank status

Risk Considerations:

- High Valuations: Current P/E premium pricing

- Execution Challenges: Digital transformation risks

- Competitive Intensity: Market share battle

- Economic Cycles: Macroeconomic sensitivity

Investment Recommendation: IDFC FIRST Bank long-term investors के लिए “Digital Banking Transformation Story” है। Current valuations premium हैं, लेकिन Warburg Pincus और ADIA का investment bank की growth potential को validate करता है। SIP approach recommended है volatility को manage करने के लिए।

Target Audience: Growth investors, digital banking theme players, और India’s financial inclusion story में participate करने वाले investors के लिए suitable है।

Disclaimer: यह विश्लेषण केवल शैक्षणिक उद्देश्यों के लिए है। निवेश से पहले अपने वित्तीय सलाहकार से परामर्श लें। Banking stocks में निवेश regulatory changes और credit cycles के अधीन है।

आपने कभी stocks में invest किया है? आपका experience कैसा रहा?

इस post को उन दोस्तों के साथ share करें जो investing में interested हैं। इस post को अपने WhatsApp groups में share करें और अपने friends की financial literacy बढ़ाने में help करें!”

- Comment section में अपना investment experience share करें – आपकी story दूसरों की help कर सकती है!”

- “आपके कोई questions हैं? Comment में पूछें, मैं personally reply करूंगा।”